54

LNG

INDUSTRY

MARCH

2016

Texas LNG is focusing on LNG consumers that are seeking

price index diversification, exposure to US gas prices, and

mid scale volumes under simple and transparent flexible

tolling agreements. Technical risk is minimised by leveraging

partners, such as Samsung Engineering, Braemar Engineering,

Air Products and Honeywell UOP. Financial advisory is

provided by BNP Paribas, ensuring that tolling agreements

are bankable and economic assumptions are realistic.

Texas LNG has secured a 625 acre deepwater site along

the deepwater Brownsville ship channel within the

Port of Brownsville in southern Texas. This site is one of the

closest sites to the Panama Canal. Emerging and established

LNG markets in Europe and South America, as well as

developing Caribbean and Central American markets, are

within easy reach. With the imminent opening of the widened

Panama Canal and reduced LNG shipping costs, exports to

Asia are also being pursued by Texas LNG.

Over 200 000 man hours of pre front-end engineering

and design (pre-FEED) and FEED engineering have been

invested in the development of the project. Work has been

completed in Houston (Texas) and in South Korea. The plant

will be built using efficient modules constructed off-site and

transported to location to minimise local construction risks.

The low risk, robust Air Products’ C3MR liquefaction process

has been chosen due to its simplicity and long-term safety

and performance record. Efforts to optimise CAPEX and to

define detailed engineering in preparation for the Final

Investment Decision (FID) in 2017 are ongoing.

The Texas LNG team, with its technical, environmental

and legal partners, including ERM (previously NRG),

K&L Gates, Greenberg Traurig and Royston Razor, submitted

all Federal Energy Regulatory Commission (FERC) pre-filing

resource reports in late 2015. Following review of the draft

documents and a series of expected information requests

from the FERC, Texas LNG anticipates grant of filing status

and submission of its formal application during 2Q16.

Submission of the draft resource reports is an important

milestone in the company’s plan to receive the permits and

approvals to commence construction of its LNG export facility

in 2017.

Focus on cost control

The project has had, and will continue to have, a focus on

reducing costs and improving efficiencies for the benefit

of the LNG offtakers. With minimal overhead costs, a

streamlined management structure, and a commitment to

reduce waste and overruns, Texas LNG is targeting a cost per

tonne of approximately US$650 – US$700, placing it within

the top quartile of US Gulf Coast projects. Cost savings will

flow directly to the tolling fees to be charged to the offtake

customers in a transparent manner. This is a dramatic change

from the traditional opaque relationship between LNG project

developer and customer.

Texas LNG’s business model is to operate on a tolling fee

basis. LNG offtakers will buy natural gas from US gas

suppliers and will have the gas delivered to the liquefaction

plant by pipeline. Texas LNG will liquefy these volumes of

natural gas and will make the product available to the

offtakers at the jetty, ready for export. It will charge the

offtakers a liquefaction charge for the liquefaction services

and the offtakers will pay a capacity fee to reserve

liquefaction capacity in the Texas LNG terminal, as well as an

energy retainage cost to compensate for electricity costs

used by the plant. There will be no destination restrictions on

the product. The tolling fee model allows for more flexibility

than the traditional integrated LNG value chain, which

connected the wellhead to the end-user under rigid,

long-term contracts. The tolling model is attractive for

customers with significant fluctuation in offtake volume.

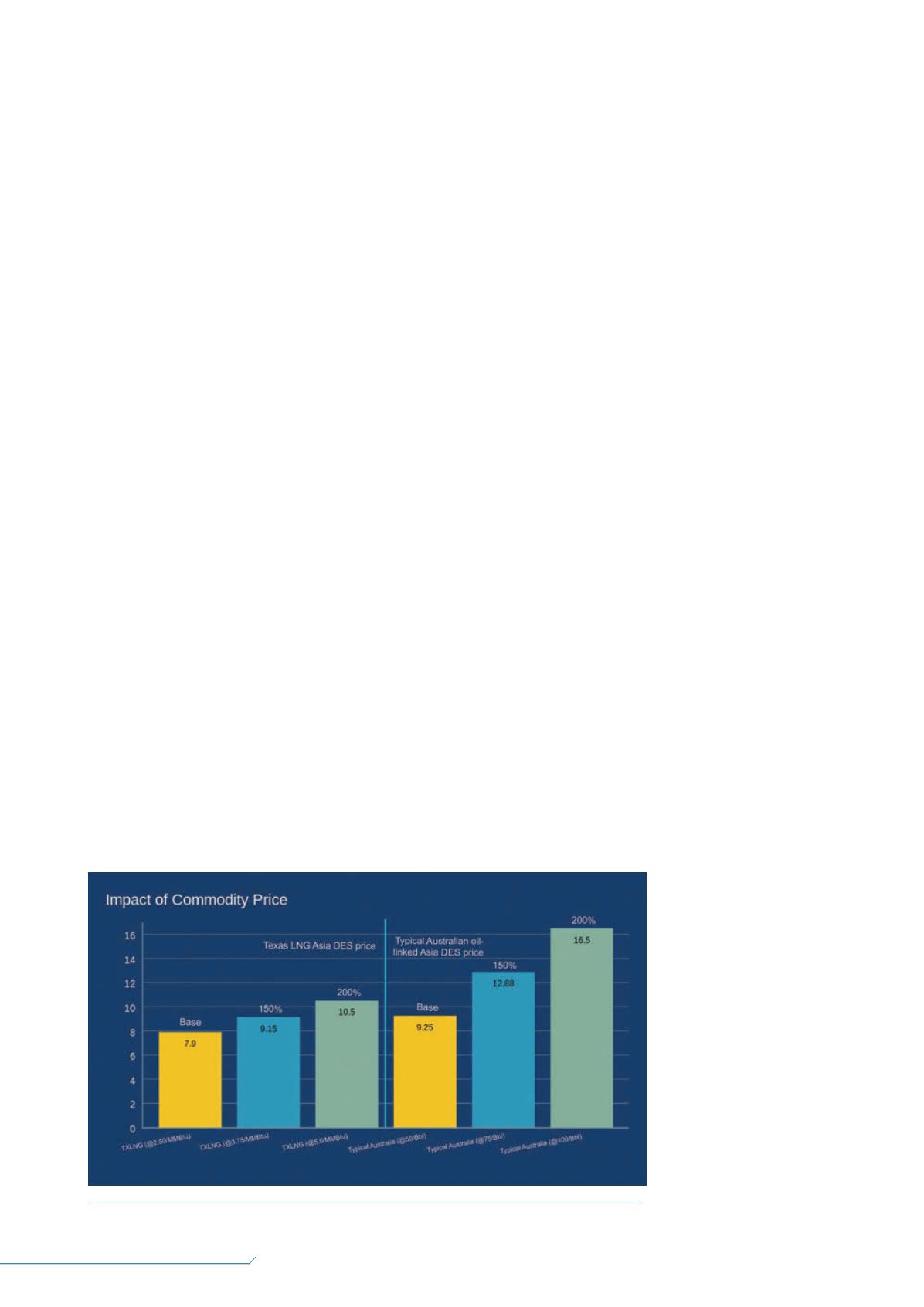

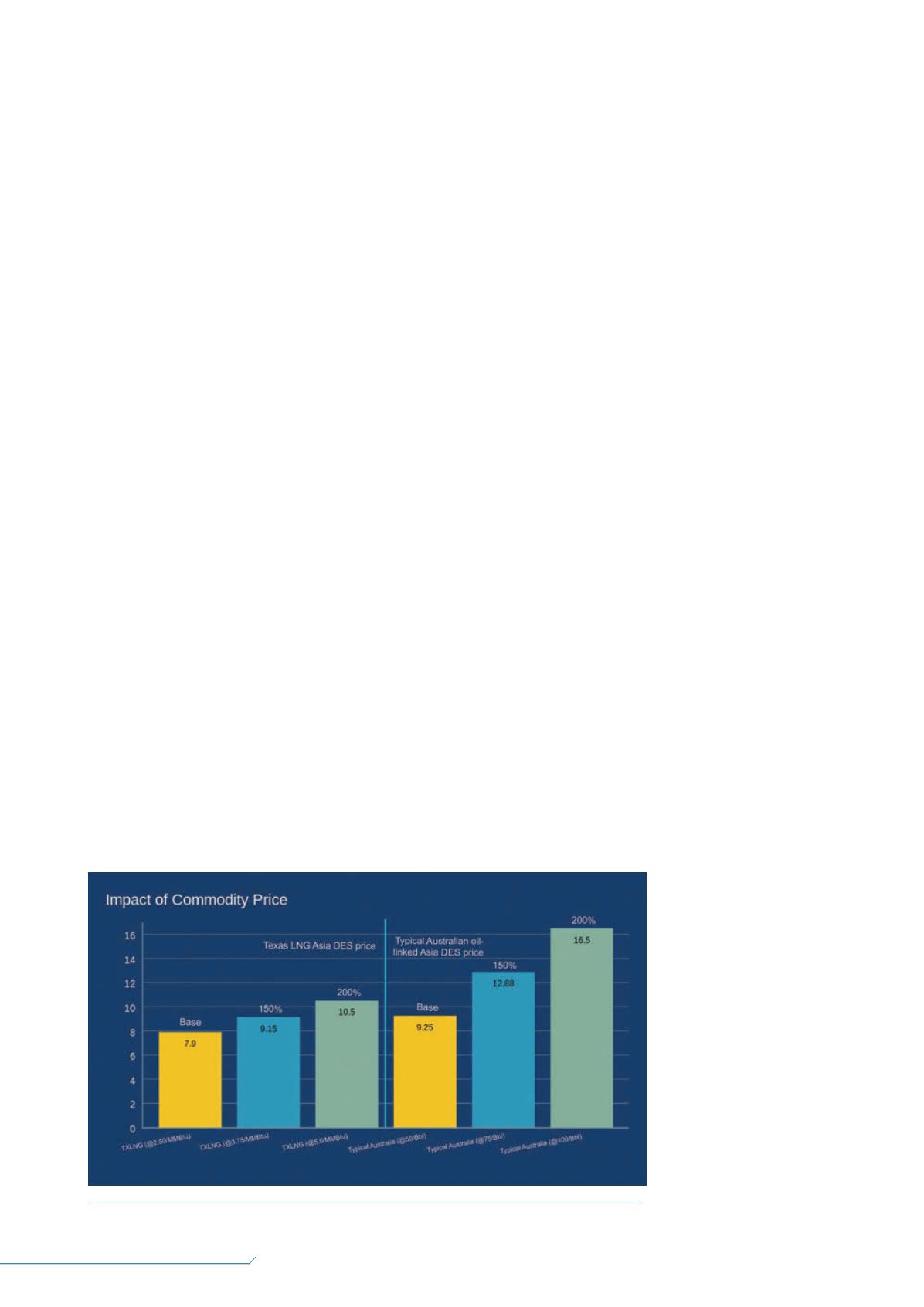

Assuming that US feed gas is priced at

US$2.50/million Btu, Texas LNG expects to be able to ship

LNG on a Free On Board (FOB) basis from Brownsville at

US$5.80/million Btu plus energy retainage cost. This

estimated price would consist of the feed gas price at

US$2.50/million Btu, a pipeline tariff of US$0.30/million Btu,

capacity fees of US$2.80/million Btu and a liquefaction

charge of US$0.20/million Btu. With the shipping cost to

Europe estimated to be approximately US$1.10/million Btu,

deliveries to Europe could be made at US$6.90/million Btu.

Similarly, deliveries in Asia would be at a price of

US$7.90/million Btu. It is important to note that the US feed

gas price is currently less

than US$2.00/million Btu

and the company continues

to evaluate further cost

saving initiatives.

Current Asian spot prices

are less than Texas LNG’s

delivered cost. However,

LNG buyers are seeking to

diversify their pricing index

away from oil-linked prices.

If oil prices rise (as they will

at some point in the next

20 years), linked LNG price

contracts will rise

proportionally. By contrast,

because of the large gas

surplus in the US, many

analysts expect US gas

prices to stay below

US$3.00/million Btu in the

Figure 1.

Impact of commodity price.