January 2020

15

In August 2018, Excelerate commissioned the Moheshkhali

floating LNG (FLNG) terminal, Bangladesh’s first LNG import

facility.

8

A second FLNG import terminal commenced operations

offshore Moheshkhali Island earlier last year.

Bangladesh is switching focus to land-based developments

and building its first onshore LNG import terminal, a

7.5 million tpy operation, including receiving, unloading, storage

and regasification. According to Reuters, at least 12 companies

are bidding for the project including QP, Exxon-Mobil, Total,

Samsung and Shell.

9

The decision to focus onshore may reflect the painful

lessons learnt from Bangladesh’s first FLNG terminal where

technical issues and adverse weather events delayed LNG

shipments. A land-based terminal with larger import capacity

has more attractive economics than smaller floating storage

and regasification units (FSRUs), which typically work better

with short-term and mid-term demand. There is a finite window

of opportunity too. Bangladesh has shortlisted 17 companies for

its spot tender process planning to buy approximately

1 million tpy of LNG in 2020 to capitalise on low gas prices.

10

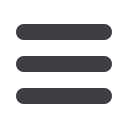

Australia

Strange things do happen. Australia is about to find itself in the

position of being both a producer and consumer of LNG.

11

A spike in domestic gas prices, driven in part by the

demand-pull of the Gladstone LNG export projects, together

with domestic gas supply shortfalls and high production costs,

has opened the door to LNG imports.

Energy affordability and security are frontline political

issues with Australian households and businesses wilting under

the pressure of high gas prices.

Building a trans-continental gas pipeline from the west

– where gas is in relatively plentiful supply – to customer

demand centres on the east coast is highly capital intensive.

Developing Greenfield gas fields faces numerous regulatory and

environmental barriers, not least moratoriums on onshore gas

development imposed by several states. LNG import terminals

are the path of least resistance.

There are currently five proposed LNG terminal projects.

Some have targeted startup dates as early as 2020. From a

project developer perspective, time is of the essence as the

current gas shortage enhances project economics and will

likely support at least one import terminal, possibly more.

Indonesia

Indonesia is a country abandoning plans to import LNG

following several major gas discoveries. The strategic plan

to attract overseas upstream investment has paid dividends

with major discoveries and project approvals fundamentally

changing Indonesia’s gas production outlook. What’s more,

faced with lower wholesale electricity prices, Indonesian power

plants are leaning on cheaper coal. All of this has curtailed

investment in domestic gas infrastructure and reduced

Indonesia’s need for LNG imports.

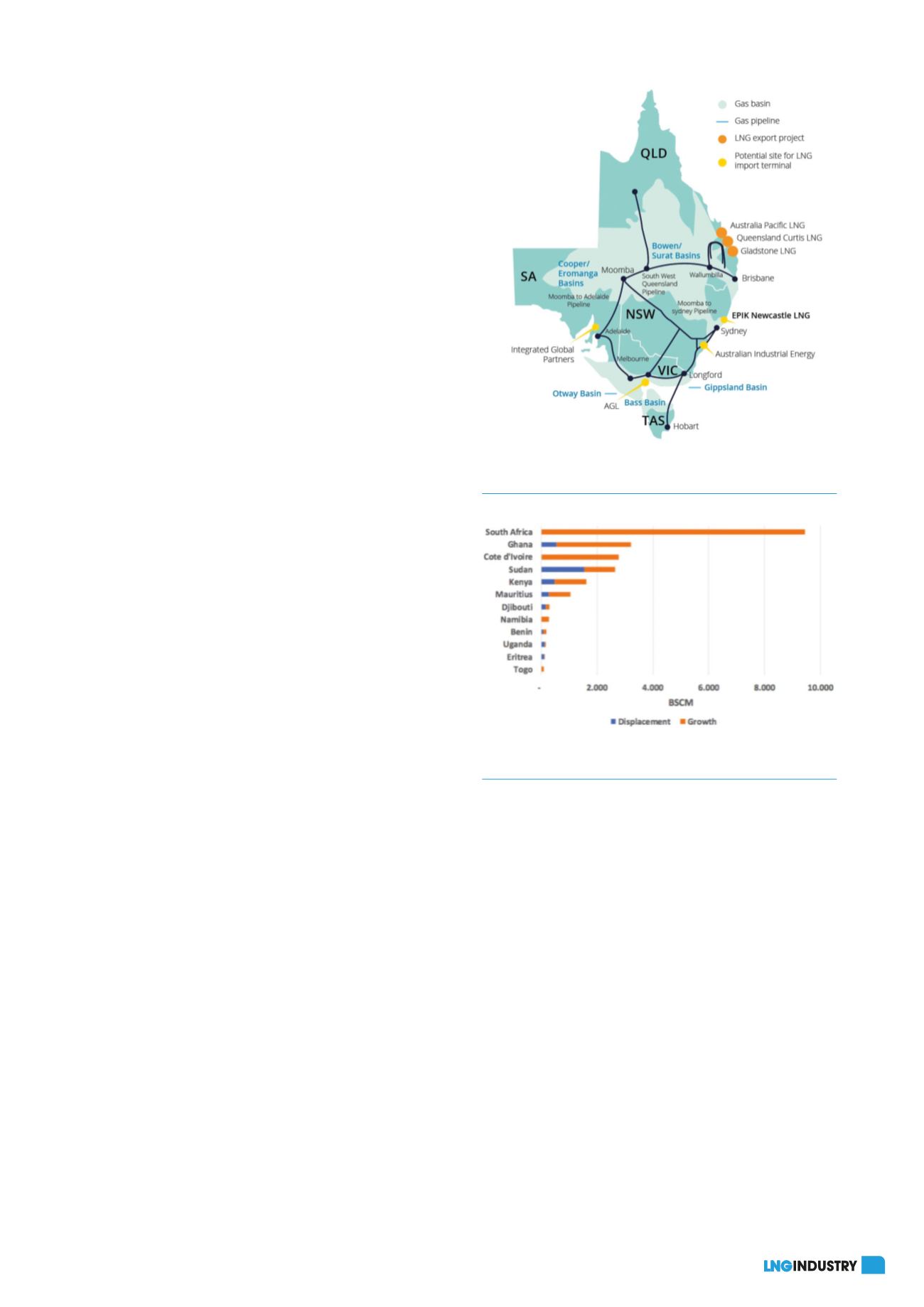

Africa

Africa represents a big commercial opportunity for LNG given

the size of the population, rising living standards, energy

demand outlook and shift towards cleaner energy sources.

Like many of the emerging LNG customer markets, Morocco

is a net energy importer looking to diversify energy supply and

reduce dependence on foreign oil and coal. Morocco’s 2030

vision plans for more gas-fired power plants and renewables.

The bid process for Morocco’s LNG import terminal in Jorf Lasfar

is still ongoing with the project not expected until 2025. Typical

of many of the projects we see in the emerging markets, this is

an integrated gas-to-power project consisting of an LNG import

terminal, marine jetty, gas pipeline network and a 2400 MW

combined cycle gas turbine.

Another African nation tilting towards LNG is Ghana, set to

be the very first sub-Saharan nation to buy LNG. Backed by

private equity, Ghana signed a deal in September 2018 with

two Chinese engineering firms to build the 2 million tpy

Tema FLNG import facility. The project is due for completion in

2020.

12

Other countries in the West African Power Pool (WAPP) — a

collective of interconnected electricity grids across national

borders – are also looking to build LNG import capacity. This is

a big list of countries including: Mali, Burkina Faso, Niger,

Senegal, Gambia, Guinea-Bissau, Guinea, Sierra Leone, Liberia,

Côte d’Ivoire, Togo, Benin and Nigeria.

South Africa is pushing to diversify its energy sources away

from coal, which supplies more than 90% of electricity.

State-owned freight logistics firm Transnet plans to launch a

tender this year for South Africa’s first LNG import terminal at

Figure 5.

Potential demand growth in gas importing

countries.

Figure 4.

LNG import proposals in Australia’s east coast gas

market.