12

April 2020

US$1.5 billion in German Government loan guarantees, with

the stipulation that Pieridae refrain from hydraulic fracturing

in the extraction process.

On the downstream side, Pieridae initially entered into an

agreement in 2013 to supply German utility Uniper with

4.8 million tpy of LNG over a 20-year term. Uniper retains the

right to terminate the agreement if Goldboro fails to meet

certain deadlines, however. Sanctioning for Train 1 has already

been deferred several times, although Pieridae in July 2019

negotiated an extension of its positive FID deadline to the

end of September 2020, with commercial deliveries to Uniper

guided for a startup date at some point between

November 2024 and June 2025.

While the purchase from Shell could signal Pieridae’s

long-term commitment to Canadian LNG on the one hand,

doubts persist over the company’s financial resilience. In

particular, the Shell deal raised local concerns regarding the

ability of such a modestly capitalised player to cover its asset

retirement obligations should market conditions result in

insolvency or a withdrawal of German Government financial

support. A senior executive from Canadian Natural Resources

Ltd criticised the transaction in a letter to the Alberta Energy

Regulator in November 2019, complaining that the regulator’s

current system of rating liabilities was flawed and failed to

accurately account for well abandonment costs. Complicating

the matter is the idiosyncrasy of hydrocarbon production in

Alberta’s Foothills. Natural gas from the area is higher cost

and contains higher levels of poisonous hydrogen sulfide

(H

2

S), thus complicating any reclamation work that would

need to be carried out under a potential receivership scenario.

Local mid-size upstream players, prompted by persistently

volatile natural gas prices in western Canada, have likewise

emerged as proponents of a more integrated LNG approach. In

February 2019, a group of 10 Canadian natural gas producers

with collective output of approximately 3 billion ft³/d formed

the Rockies LNG Partnership. The consortium’s stated aim is to

receive regulatory approval for a 12 million tpy facility, attract

a larger partner to provide capital, and ultimately supply the

project with its own natural gas. Consortium members include

Deep Basin natural gas producer Peyto Exploration &

Development, as well as Montney producers such as

Advantage Oil and Gas, Birchcliff Energy, and

Seven Generations Energy, among others. Canbriam Energy

withdrew from the consortium following its acquisition by

Pacific, reducing the number of members to nine.

In October 2019, Rockies LNG CEO Greg Kist indicated an

imminent start to the regulatory process with a

commissioning date tentatively scheduled for 2026.

Additionally, the consortium plans to supply the project via a

long-haul pipeline with some existing regulatory approvals.

Project partners have expressed interest in Enbridge’s

Westcoast Connector Gas Transmission Project and TC Energy’s

Prince Rupert Gas Transmission route, which were originally

intended to service Shell’s Prince Rupert LNG project

(21 million tpy) and the Petronas-operated Pacific Northwest

LNG project (18 million tpy), respectively. Both LNG schemes

were cancelled in 2017, although their corresponding

midstream projects already have environmental certificates

and have completed a certain amount of permitting.

Considering the pipeline routes under consideration,

Rockies LNG’s implied site location is likely to be somewhere

in B.C.’s Prince Rupert area, which is located near the Alaska

border approximately 115 km northwest of Kitimat.

Additionally, project partners have tentatively indicated plans

to develop the project as a floating LNG (FLNG) facility. Under

this scenario, Rockies LNG would potentially require three

barges and forego capital-intensive land-flattening activities

associated with onshore developments, although no cost

estimates have been disclosed yet.

The emissions imperative and

federal policy carrots

In tandem with greater integration with upstream

supply, Canadian LNG development concepts have

taken a greener turn since late 2018. In large part, this

development has resulted from B.C.’s increasingly stringent

greenhouse gas (GHG) emissions requirements, although the

federal government has provided some financial support for

improvements in energy efficiency.

On the regulatory front, the B.C. provincial government in

late 2018 adopted stricter provincial GHG emissions targets as

part of the CleanBC plan. CleanBC ultimately aims to reduce

provincial emissions to approximately 12.75 million tCO

2

e

annually by 2050, or 80% below 2007 emissions levels. In

terms of the energy industry specifically, the plan caps

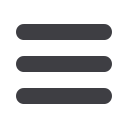

Figure 1.

Pacific Oil & Gas Montney production by

hydrocarbon type and proposed Woodfibre LNG output

(million ft3/d). Source: Rystad Energy UCube.

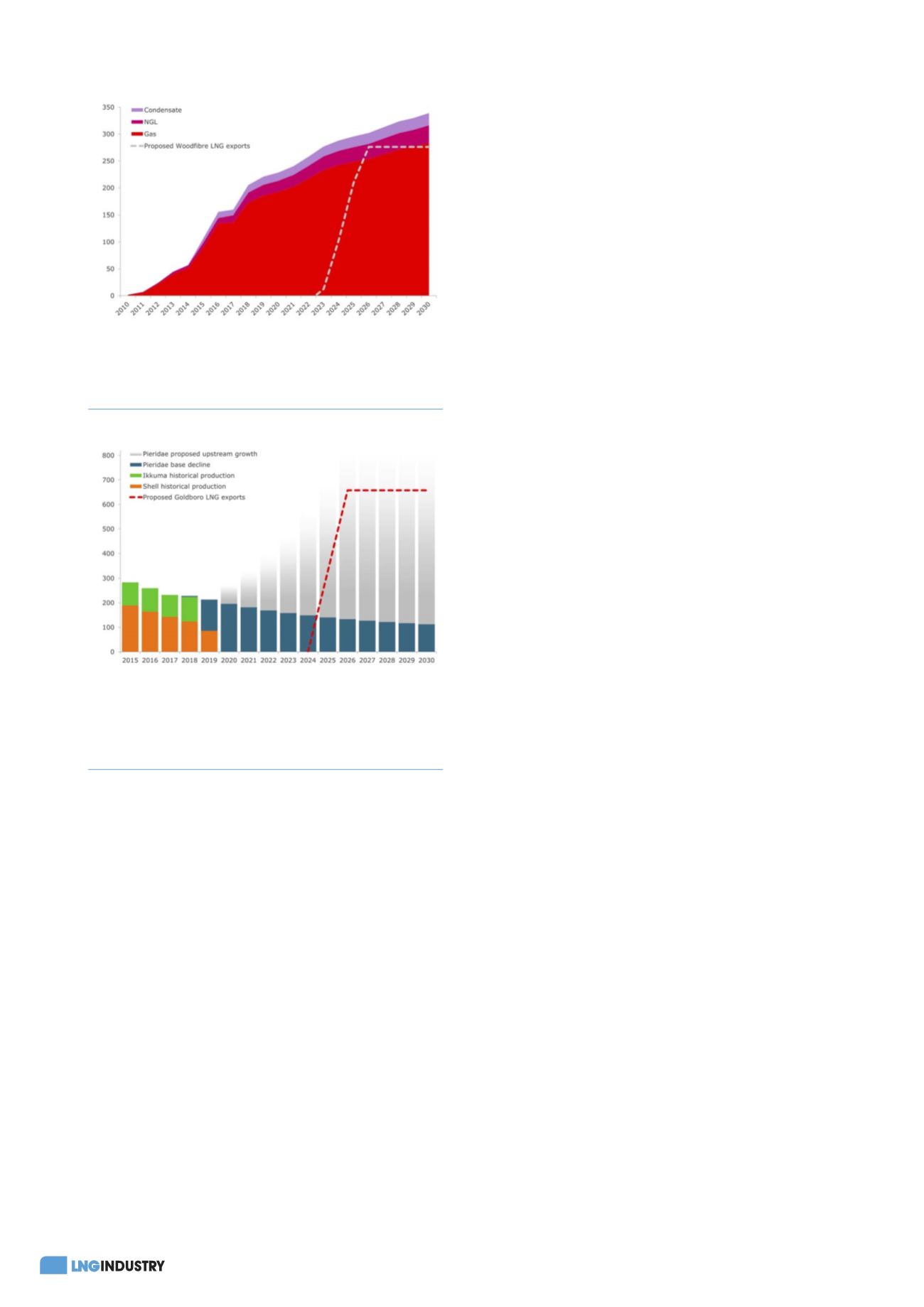

Figure 2.

Pieridae Energy production by historical company,

proposed growth profile, and proposed Goldboro LNG

output (million ft3/d). Source: Rystad Energy UCube;

Rystad Energy research and analysis.