14

April 2020

emissions from LNG plants at 0.16 million tCO

2

e, meaning

that new LNG developments of any size would effectively be

required to utilise electric drive technology to comply with

provincial standards. Electric drive, in turn, would have the

benefit of powering the liquefaction process through B.C.’s

abundant hydroelectric resources as opposed to

higher-emitting natural gas turbines.

Although CleanBC was followed by the cancellation of

ExxonMobil’s Westcoast Canada project (December 2018) and

Steelhead LNG’s Kwispaa scheme (February 2019), at least one

major project sought to reconcile its emissions profile with

B.C.’s revised targets.

In April 2019, Chevron submitted an amended

application to the Canada Energy Regulator (CER) for the

Kitimat LNG project, a 50/50 joint venture with Woodside

Energy. Originally consisting of two gas-powered liquefaction

trains with total capacity of 10 million tpy and a 20-year

export licence, the revised application envisioned the

project’s expansion to three trains with capacity of

18 million tpy and a 40-year export licence. Most crucially,

Chevron committed to powering the facility with electric

drive as opposed to feed gas, thus reconciling Kitimat with

CleanBC. In December 2019, federal regulators approved the

reconceptualised project.

LNG Canada also saw a reduction in its emissions profile

and something of a policy carrot. In summer 2019, the

federal government provided the project with

CAN$220 million in funding for more energy-efficient gas

turbines, which aim to lower fuel use in the liquefaction

process and thus reduce the emissions profile of Trains 1 – 2.

The investment builds on an emissions profile that is already

comparatively low in terms of global LNG projects. In any

case, 80% of LNG Canada’s power needs were slated to come

from natural gas feedstock, with the remaining 20% being

sourced from hydroelectric utility BC Hydro.

Woodfibre LNG had already committed to electric drive

following community consultations in Squamish in 2014.

Woodfibre likewise received regulatory support in

August 2019, when the federal government exempted the

project from fabricated steel duties that the

Canadian International Trade Tribunal had previously

imposed in 2017. As such, one of the final barriers to a

positive FID was removed and Woodfibre ordered a major

piece of project equipment. A positive FID, however, was

punted further into 2020 due to last-minute amendments to

its worker accommodation plans. Given the duties exemption

and Pacific’s successful acquisition of Canbriam Energy,

however, Rystad Energy expects a positive FID for Woodfibre

at some point in 2020.

Local solutions to Canada’s LNG

challenge

Regulatory approval for the Kitimat amendments

notwithstanding, Chevron put its 50% stake in the project

up for sale in late 2019 following a review of its long-term

natural gas price outlook. The supermajor recorded an

impairment of approximately US$10.4 billion in 4Q19,

driven by its share in Kitimat, as well as upstream shale

gas projects in the Appalachian basin. Similarly, in February

2020, Woodside recorded a AUS$720 million impairment

of its Kitimat asset, which includes both its stake in the

LNG export terminal as well as upstream assets in the

Liard Basin.

Recent experience with Kitimat has been bittersweet,

perhaps. While its conceptual retooling demonstrated the

global competitiveness of lower-emissions LNG projects,

Chevron’s announcement likewise underscored the continued

vulnerability of Canada’s LNG industry to the vagaries of

portfolio optimisation, particularly when major foreign

players with diversified portfolios are involved.

Looking forward, the experience of Rockies LNG may

prove most salient for Canada’s LNG future. While LNG

Canada and Woodfibre – that is, projects with the highest

chance of success at this point – will no doubt be a boon to

the industry, large scale future developments may ultimately

hinge on the collective efforts of local upstream players

with more skin in the game. To be sure, the WCSB’s natural

gas potential is enormous, bolstered by large reserves of

liquids-rich gas with favourable economics. While western

Canada’s upstream industry will of course benefit from

greater connectedness to markets in eastern Canada and the

US in coming years, as well as modest increases in in-basin

demand, market diversification away from North America

will no doubt prove crucial in the long-term.

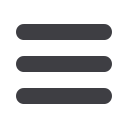

Figure 3.

British Columbia (B.C.) historical

greenhouse gas (GHG) emissions by industry and future

targets (million tCO

2

e/yr). Source: Province of B.C.

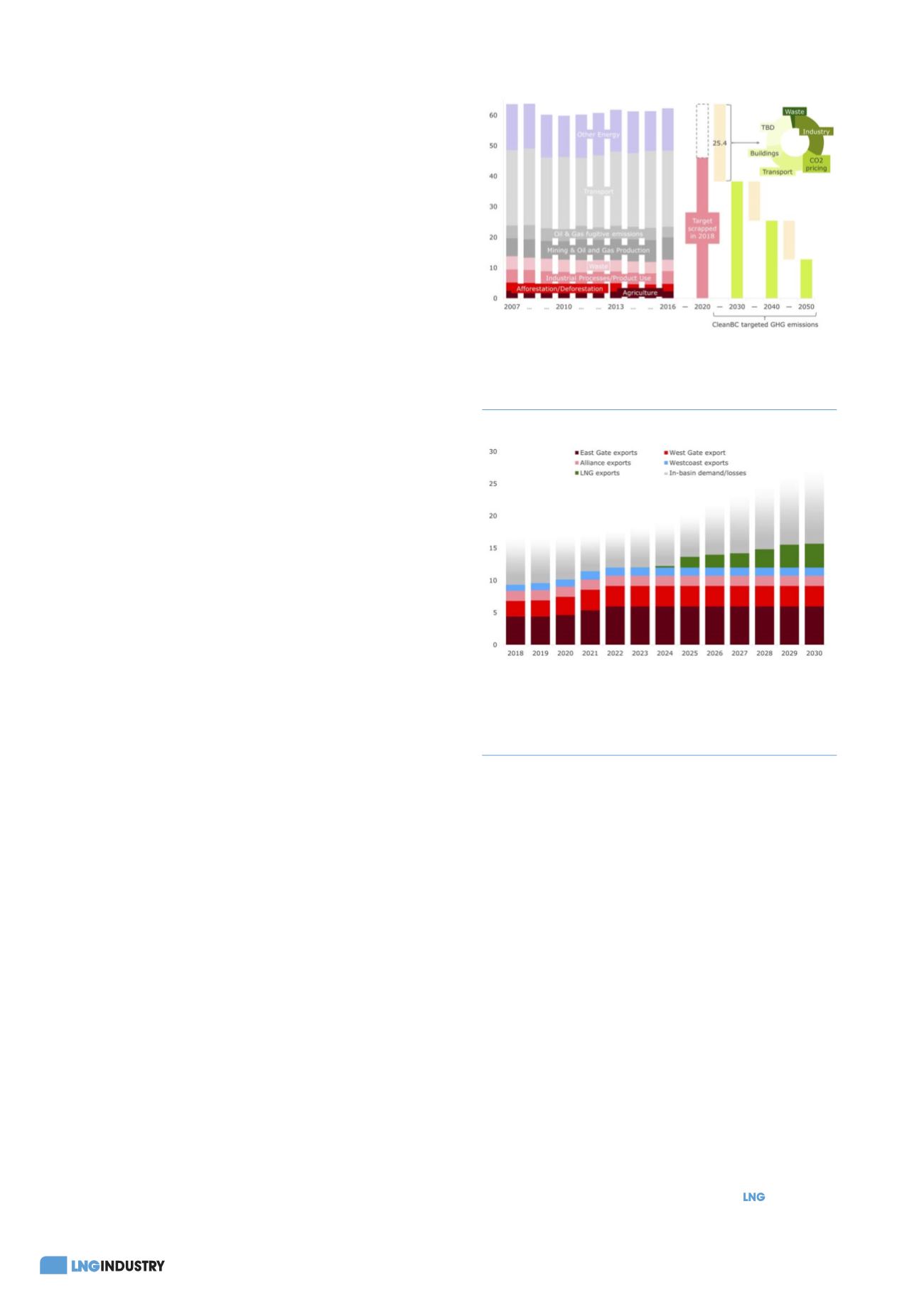

Figure 4.

WCSB natural gas production by offtake/demand

source (billion ft3/d). Source: Rystad Energy GasMarketCube;

Canada Energy Regulator; company reporting.