34

LNG

INDUSTRY

MARCH

2016

LNG terminals

With this objective in mind, many solutions have been

recommended within the region over the past decade. In

addition to the growth of renewables, increased import of

LNG into the Caribbean has been suggested as a way to help

control energy costs and decrease greenhouse gas (GHG)

emissions. However, with a handful of exceptions, such as

the EcoEléctrica terminal in Puerto Rico and the AES terminal

in the Dominican Republic, most Caribbean islands can not

justify a traditionally sized LNG import terminal both from a

scale and CAPEX perspective. A potential solution proposed

to allow for small vessel loading and export has been to

build or modify terminals that can be purpose-built for this

market. While this seems interesting in theory, the cost of

LNG production at these facilities is often high and perhaps

not commercially competitive with cargoes sourced out of

the global LNG supply glut.

ISO tank

containers

Another technology

that has emerged as

a bridging solution

when terminals either

do not exist or will not

accommodate the needs

of small scale customers

is based upon the

transport of LNG in ISO

tank containers. These

small LNG tanks can be

loaded at a terminal in a

similar fashion to the way

LNG trucks are loaded,

transported to a port,

and shipped to various

markets. Fully loaded,

ISOs hold between 800

and 1000 million Btu

of LNG. Although the

Caribbean islands are

considered small by

some standards, shipping

a multitude of ISOs

creates a challenging,

costly and high-risk logistics scenario. The smaller scale of

these projects can result in escalated transportation costs

and losses of efficiency. In most cases, the traditional LNG

model almost always wins, especially when travelling

significant distances. There is a role for ISO containers to

play in small scale LNG, but perhaps it is not as a competitor

to bulk LNG deliveries to power plants.

Floating storage and

regasification units (FSRUs)

The theme of needing to make LNG ‘smaller’ to facilitate

lesser markets also trickles down into the size of the

vessels. The vessel must be aptly sized for the market

as customers will not pay for volumes they do not use.

However, the pricing indications to build smaller sized

LNG carriers appear extremely escalated (in the tens or

even hundreds of millions). It will be difficult to enable this

market with numbers like this, and it can deter regional

energy consumers from the accessibility of LNG.

Over a decade ago, Excelerate Energy saw the need for

a cost-efficient, fast-track solution for the importation of

LNG and introduced the concept of a floating storage and

regasification unit (FSRU). FSRUs act, in many aspects,

similarly to land-based terminals. In addition to transporting

LNG, FSRUs have the onboard capability to vaporise LNG

and deliver natural gas through specially designed offshore

and near-shore receiving facilities. FSRUs typically unload

volume in three ways: as a liquid at a conventional LNG

receiving terminal; as a gas through the FSRU’s connection

with a subsea buoy in the hull of the ship; and as a gas

through a high pressure gas manifold located forward of the

vessel’s LNG loading arms. FSRUs can deliver regasified

LNG at pipeline pressure at flowrates ranging from

50 to 800 million ft

3

/d, providing quick and convenient

access to gas supplies. Although the Caribbean islands often

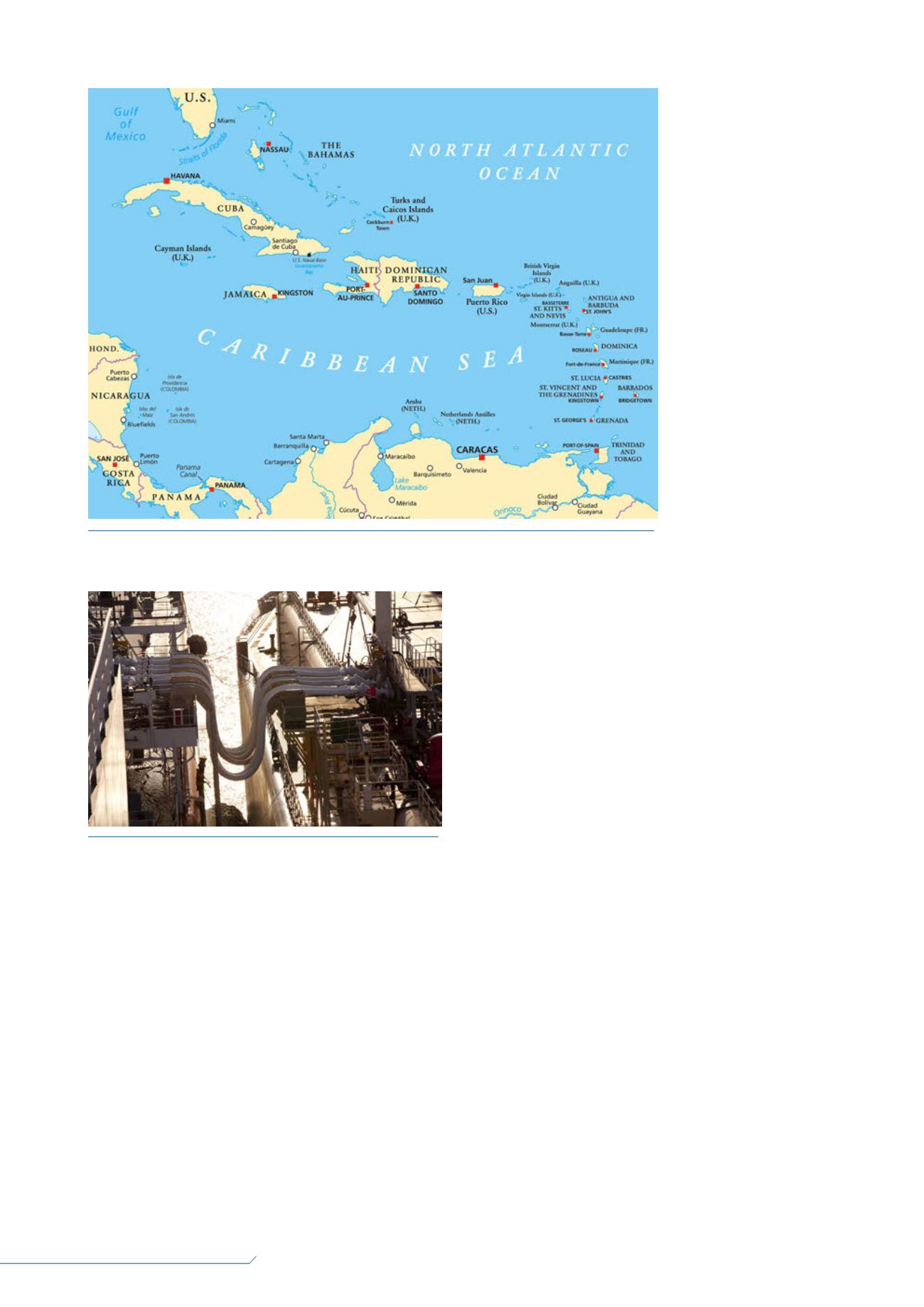

Figure 1.

The Eastern Caribbean islands.

Figure 2.

Excelerate Energy has transferred over

90.5 million m

3

of LNG.