74

LNG

INDUSTRY

JULY

2016

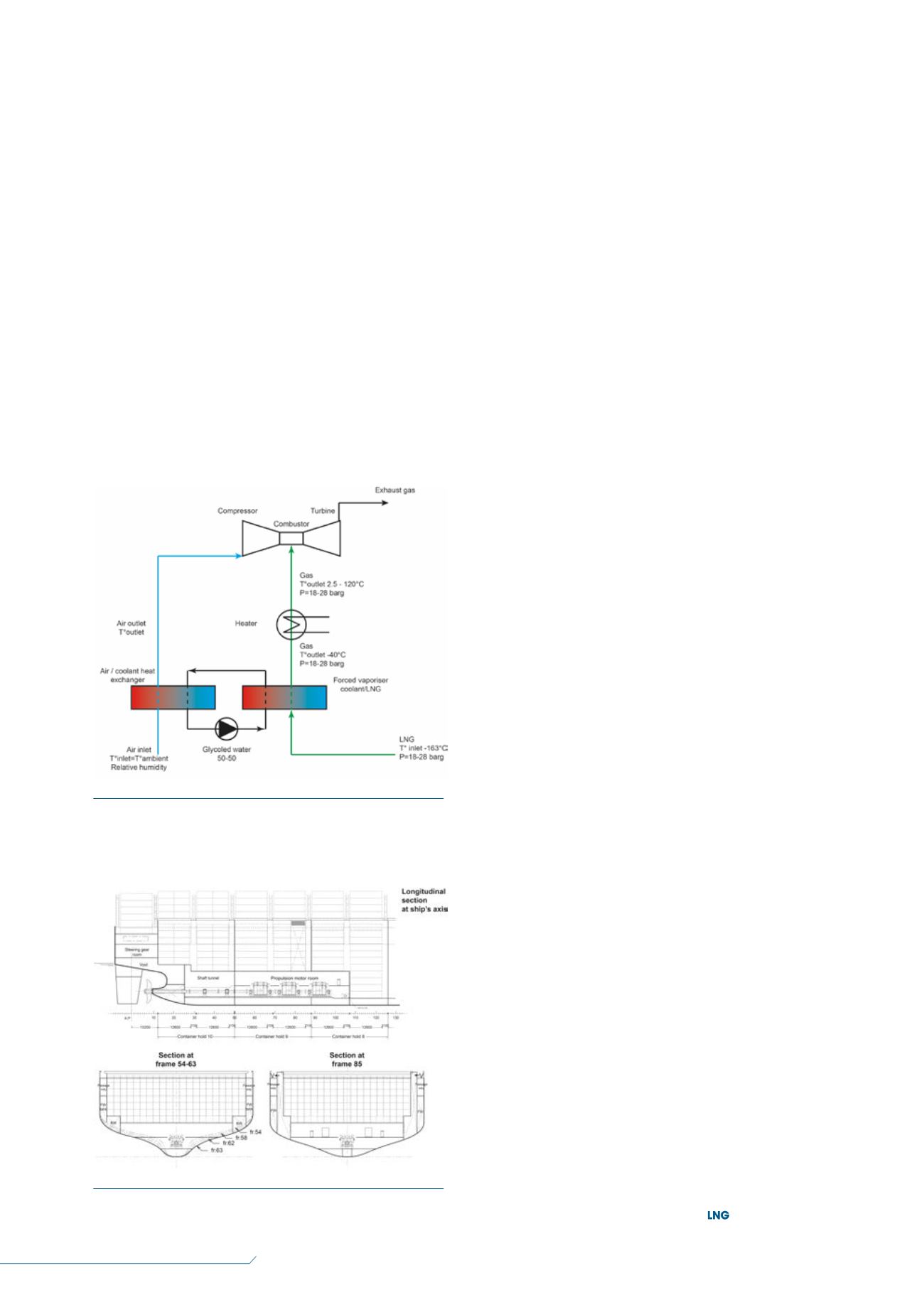

The general layout of the propulsion room is illustrated in

Figure 5.

Ship’s cost and incomes

Incomes

Essentially, the income generated by a container vessel is

proportional to the quantity of containers being carried and applied

freight rates. The number of containers being carried by a vessel on

a given journey depends on both the ship’s geometric capacity and

the remaining payload available.

The first step of this study shows that geometric capacity is

enhanced (+377/HFOdesign and +860/dual-fuel), while the

payload slightly increases (due to the fact that the COGAS

propulsion system is lighter than a two-stroke diesel engine).

This extra capacity is a competitive asset, especially with high

freight rate.

CAPEX

A preliminary cost-benefit assessment has beenmade to compare

the COGAS vessel to HFO and dual-fuel designs.

Within this analysis, the additional costs mainly related to LNG

tanks, the LNG handling system, gas and steam turbines, and

electric propulsion (e-motors, drives, converters, etc.).

Furthermore, the following systems do not exist on the

COGAS design, so further savings can bemade:

Scrubbers and NO

X

reducers.

Main engine (replaced by electric propulsionmotors).

HFO tanks and heating system.

HFO treatment system.

Sludge handling and storage system.

At this stage of the study, the cost of the COGAS vessel is

evaluated to be approximately 20%above the price of an HFO

design (fitted with scrubbers) and 13%above the dual-fuel design.

OPEX

For any ship, operational costs mainly consist of the following:

Crew costs.

Repair andmaintenance costs.

Fuel and lubrication oil (and all other consumables) costs.

Ship’s store.

Administrative and insurance costs.

The second phase of the study will specifically evaluate all of

the operational costs for a specific operational profile defined by

the ship owner.

Conclusion

The implementation of tighter ship emission control is a new

challenge for the shipping industry.

Essentially, the following three options are available:

Keeping HFO as fuel, but adding scrubber systems.

Shifting to themarine gas oil or a low sulfur fuel.

Shifting to natural gas.

For the ship owners, the choice between these options will be

determined by the following criteria:

The technical feasibility of implementing a solution on an

existing or newbuild vessel.

The capacity for ship owners and shipyards to find suitable

equipment and fuel.

The cost-effectiveness given by the net present value.

Technically, LNG offers a promising solution, as it is a clean fuel

and is already used by hundreds of LNG carriers around the world.

At the time of writing, however, LNG bunkering services were

limited to just a couple of harbours. Nonetheless, several bunkering

projects are underway to support the increasing demand for LNG

as fuel.

Above all, the deployment of LNG as fuel on a large scale

within the shipping industry is conditioned by cost-effectiveness.

For ship owners, shifting fromHFOor MGO to LNG is a great

challenge and risk, which cannot be accepted purely for

environmental reasons. LNG as fuel must be cost-effective

compared to classic fuel oil.

To achieve this aim, new ship concepts need to be designed

and evaluated without prejudice. This is what Marine

Assistance has been doing in this COGAS feasibility study

led by GTT, CMA CGM and DNV GL.

Figure 5.

Extract of the propulsion room plan

(

©

Marine Assistance/ABB).

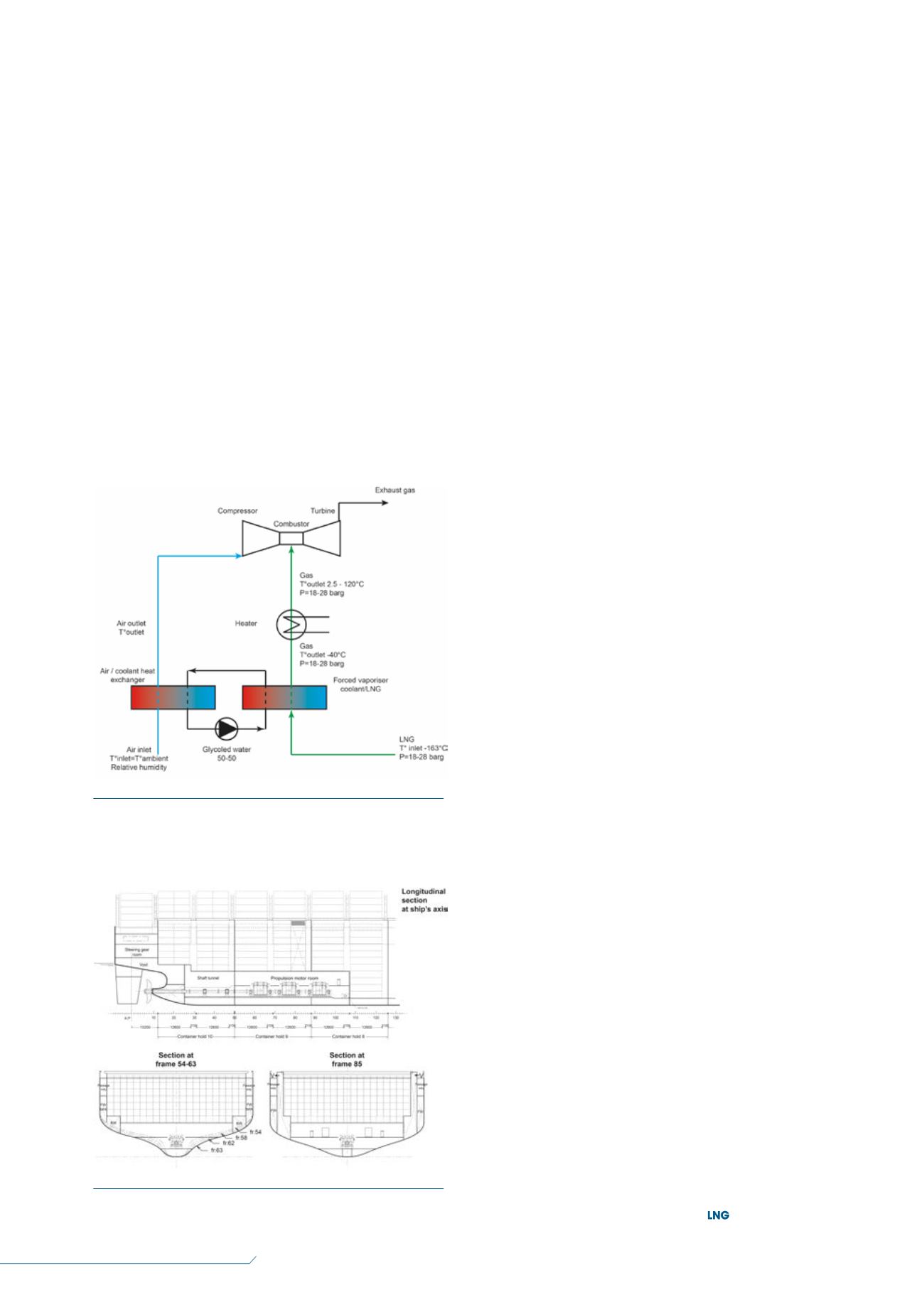

Figure 4.

Principle diagram of the LNG vaporisation and air

combustion cooling (

©

Ariamis).