between 174 000 m

3

and 180 000 m³. However, while trends

in vessel size are primarily driven by terminal capacity, there

is also work being done by some shipyards to design a new

‘post-Panamax’ LNG carrier design. These vessels would be able

to transit the newly expanded Panama Canal locks that can

now accommodate vessels with capacity up to 200 000 m³.

Furthermore, some Chinese receivers are reportedly

interested in further increasing ship sizes with a new design,

known as the ‘Chinamax’, which would boast a capacity of up to

260 000 m³. Whether this project comes to fruition remains to

be seen – it appears that most charterers and owners are

satisfied with the present standard sizes, and there is no clear

view whether many larger ships will be built or what their

markets would be. This is principally due to the fact that traders

prefer cargo parcel sizes that fit the 174 000 – 180 000 m³

vessel profile, and though ships in the 200 000 m³ capacity

range would still be able to serve the majority of Asia’s LNG

terminals, ships above this size would face significant

restrictions.

At the other end of the market, interest persists in

small scale LNG where the majority of designers and owners

prefer to build concepts around cylindrical Type C tanks,

approximately 7500 m³ in capacity, often for application in LNG

bunkering. However, several small scale projects have opted to

use membrane tanks, pushing down the limit of what is

possible for gas containment systems.

For example, ABS provided classification for the LNG

bunker barge constructed at the Conrad Orange shipyard,

Florida, which will provide bunkering services for two

TOTE Containerships also constructed to ABS class. ABS was

also selected by FueLNG to class Singapore’s first LNG bunker

vessel, an important milestone for the region and a key

component of Singapore’s strategy to become the world’s

largest bunkering port. The 7500 m³ LNG bunker vessel which

was planned for first operations before the end of 2019, will be

owned and operated by FueLNG, a joint venture between Shell

and Keppel Offshore & Marine. The vessel will be based in the

Port of Singapore and will supply necessary LNG fuel to large

ocean-going LNG-fuelled vessels throughout the region.

Conclusion

If LNG carrier technology can be said to have reached a ‘steady

state’, it is probably more accurate to conclude that the fleet

has evolved to meet the exacting demands of the trade while

retaining the necessary degree of flexibility.

Innovation has continued, as is obvious from both the

development in choices of propulsion and containment systems.

While there remains room to grow in vessel sizes, technical and

economic conditions will likely see smaller, incremental gains

than giant leaps. Instead, designers and operators are seeking

additional efficiencies which enable them to respond to

increasing volumes of spot trading and maintain fuel flexibility

and regulatory compliance. Growing interest in small scale LNG

applications – either as bunkering vessels or to supply

small scale power projects – is likely to see increasing attention

too, as more complex systems become possible on these vessel

sizes.

Taken together, these developments suggest the LNG

carrier market continues to push the boundaries of innovation,

while maintaining the sector’s enviable safety record.

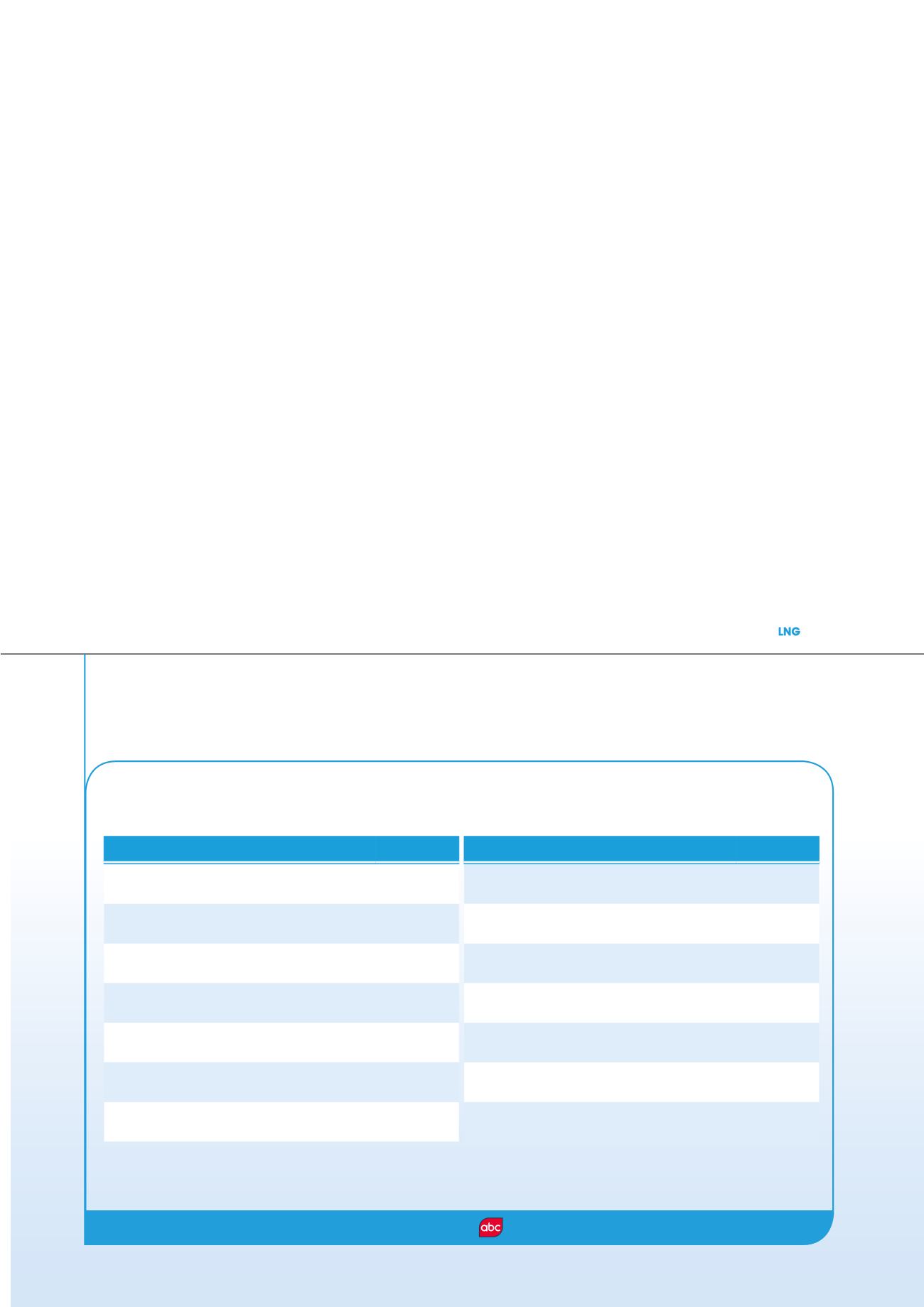

AD

INDEX

www.

lngindustry

.com

LNG Industry is audited by the Audit Bureau of Circulations (ABC).

An audit certificate is available on request from our sales department.

Advertiser

Page

ACME Cryogenics

39

Air Flow

27

Chart

11

Cheniere Energy

OFC, 19

Corban Energy Group

07

Elliott Group

05

Golden Pass LNG

02

Advertiser

Page

Matrix Service

IFC

NIKKISO

09

Palladian Publications

35, 43, 52

Qatargas

OBC

RegO

51

StocExpo

IBC

Temati

47