34

LNG

INDUSTRY

SEPTEMBER

2016

Developers have vast and diverse value interests that include

cost, schedule, quality, reliability, life span, constructability,

maintainability, etc.

1

Understanding and streamlining a process

that addresses these value interests and can be rapidly executed

is critical. The speed to market can mean more lucrative pricing

and terms with offtakers and end users.

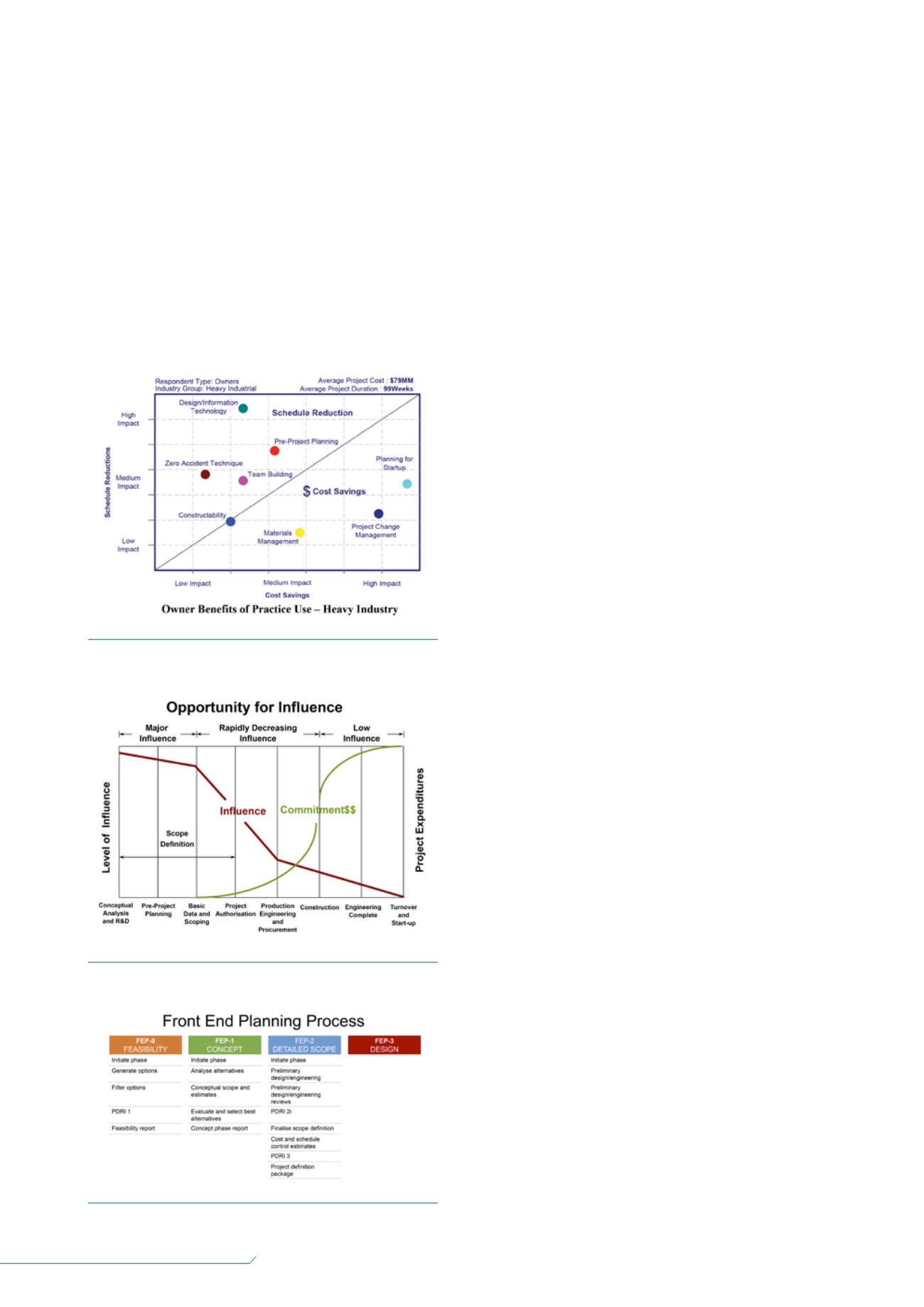

It all begins and ends with planning. In fact, pre-project

planning has been shown to have the single largest impact on

cost and schedule savings on all industry groups (Figure 1). The

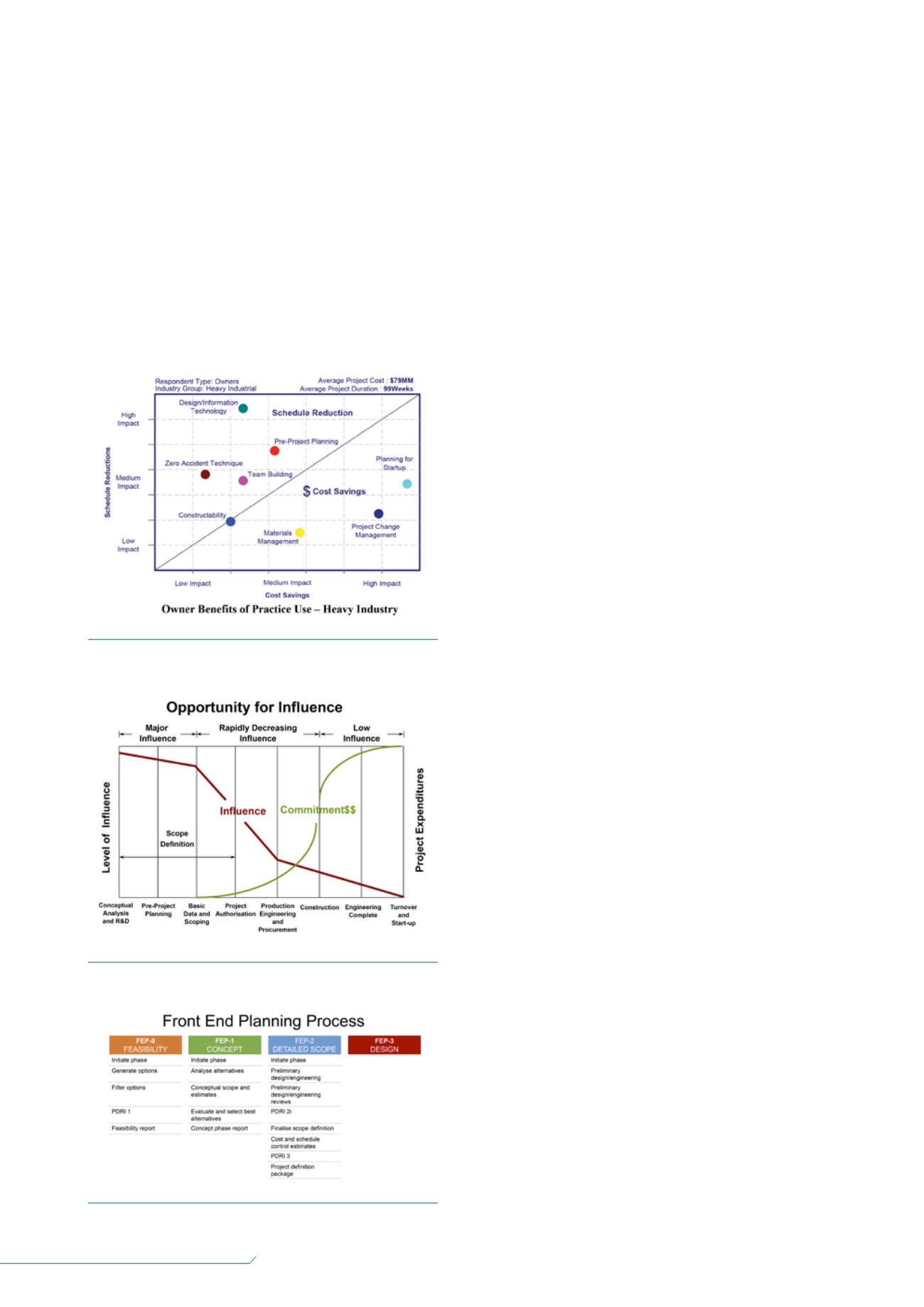

ability to influence a project (configuration, schedule, etc.) is

dramatically decreased while expenditures rapidly increase as a

project progresses. The optimum time to influence the final

project at the lowest cost is during pre-project planning

(Figure 2). A formalised and successful planning approach is the

front end planning (FEP) process, developed by the Construction

Industry Institute and discussed in its publication, RS213-1.

2

This

FEP gate process is shown in Figure 3 and consists of four

phases.

FEP-0: feasibility

The first action a developer takes toward deciding whether or

not to pursue a project is to determine its feasibility or return on

investment (ROI) – the likelihood of operating the facility at a

profit. To calculate ROI, developers rely on either sophisticated

internal models or external consultants. ROI variables include

capital cost, operating costs and time to market. In FEP-0,

parametric information is typically used. If the models yield a

positive outcome, the project is pursued. FEP-0 components

include the following:

Identification of potential technologies and technology

providers.

Determination of a potential region or location with a

significant unmet demand for LNG. This demand could be

for marine bunkering; rail fuelling; remote location, high

horsepower (HHP) equipment; or a combination thereof.

Market research includes a review of historical purchases of

diesel and heavy fuel oils (HFO), discussions with potential

users and business intelligence regarding competitors.

Establishment of initial project economics. Project

economics are tied to both estimated total LNG demand

from all potential users in the target region and the current

LNGmarket cost. The initial economics models drive

the project capital and operating costs and establish the

profitability.

Review of the federal, state and local regulations that are

applicable and determination of the jurisdiction responsible

for regulatory enforcement for the facility. Additionally,

assessment of the community view of the risks and rewards

of a future LNG facility is performed.

Identification of a suitable site for the facility. Although

the firm required footprint may be unknown, the general

space can be estimated based on similar capacity facilities.

Considerations should include additional regulatory buffer

or exclusion zones between the new facility and existing

neighbours.

If a potential parcel is available and the acquisition costs are

known, the project economic evaluation can be updated

to determine if the projected costs and revenue are still

consistent with a favourable ROI.

If a site is identified, the developer can also have a

geotechnical consultant performminimum on-site sampling

and testing to define soil properties and recommend

foundations. As an alternate, existing geotechnical data

within the vicinity can be used. This information can facilitate

preliminary designs and cost estimates in FEP-1.

Before moving on to FEP-1 (concept) and FEP-2 (detailed

scope), the developer should also decide on the contracting

approach.

In a conventional contracting approach, FEP-1 and FEP-2

studies are performed by a consultant selected by the developer

based upon reputation and expertise. At the end of FEP-2, a

detailed performance specification and scope of work is

prepared by the consultant and bids solicited from technology,

Figure 3.

Front end planning (FEP) processes.

Figure 2.

Project lifecycle: opportunity for influence.

4

Figure 1.

Owner benefits from practices used in the

construction industry.

3