remainingQueensland projects should experience the same

success, and this experiencewill eventually benefit theWA

projects as well. A greater emphasis onmarketing and trading

activities is expected.

Take costs out

While Australia’s costs have come down significantly, they still

have further to go. Suppliers and employees should expect a

ruthless and relentless cost emphasis – the only variable the

projects can control.

Collaborate more

The projects are racking up a small but successful track record in

collaboration, including safety forums, emergency preparedness,

and shutdown and turnover planning and execution, but there are

still ample opportunities for greater collaboration to take out cost

and improve productivity.

Future directions

Australia’s LNG sector is well positioned to tackle its challenges

and ready itself for the future, but what does that future hold?

So long as oil prices remain low, fewgreenfield LNG projects,

including those in Australia, are likely to be sanctioned. This is,

therefore, setting up the country’s 10 projects as viable

competitors for brownfield expansion. Indeed, the economics of

LNG projects generally improves with expansion, since there is

often considerable latent capacity in the asset mix (such as

underutilised jetties, storage assets, power generation, and

control rooms).

The focus on completing the projects has limited the capacity

for innovation. Therefore, shortly after project completion, the

innovation agenda is expected to rise in importance. Many

innovative technologies have yet to establish a significant

presence in the industry, including social media, virtual reality,

the sharing economy, autonomous vehicles (rigs, trucks, drones),

additivemanufacturing, the internet of things, nanotechnology,

energy storage solutions, analytics, andmobile and tablet

computing.

The industry should also soon be undertakingmore

aggressive capital recycling programmes. Many of the gas

processing assets in the onshore value chains, including the

plants, water treatment facilities and pipelines, could be spun off

to third party operators. This would free up capital to finance

expansion of the gas fields to grow the sector. Themore

developed gas markets in North America have separated the

gas processing sector fromgas field owners, which has resulted

in a better optimised capital allocation that matches low return,

low risk assets with appropriate shareholders.

Finally, the overall industry will be seeking a significantly

lower regulatory burden, and Australia’s various governments

should be stepping up to assist. The industry competes for

capital with other global basins, and not for gas in Australia (the

competition for resources ended long ago). While suppliers,

owners and operators will do their best to improve sector

economics, the regulatory burden and related compliance costs

are a direct charge against the slim royalties governments need

to finance public sector debt, operations and social programmes.

Conclusion

Australia will be the world leader in the LNG sector and has

bright and exciting prospects as it races to conclude the

immediate slate of development.

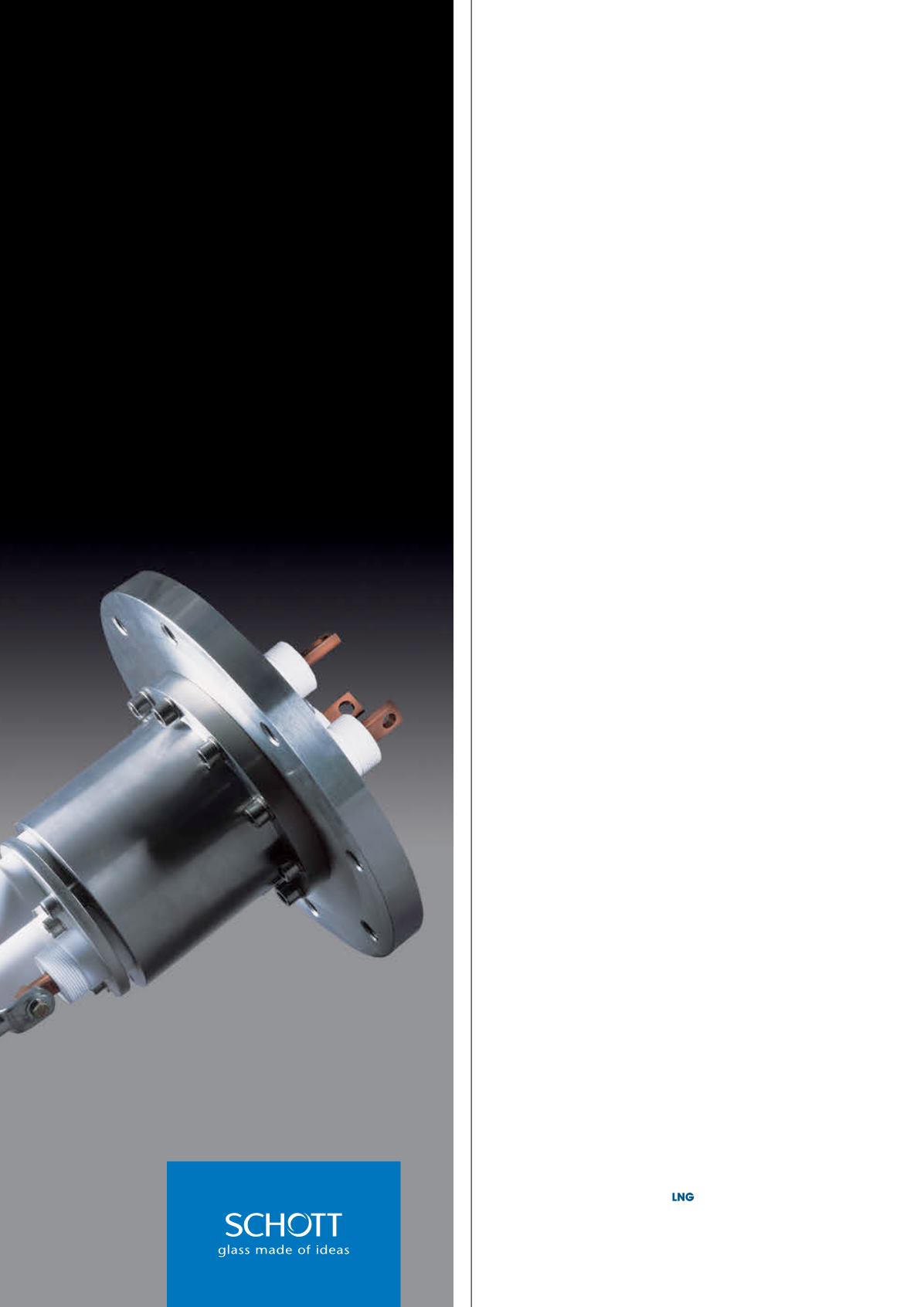

Small component –

Big Impact.

SCHOTT Eternaloc

®

Terminal Headers

Electrical terminal headers are small, yet safety-

critical components of LNG vessels and terminals.

They hermetically feed electricity and data to

submerged LNG pumps, turbine expanders and

compressors. At the same time their quality and

reliabilty is critical to uphold the pressure vessel

integrity and therefore the safety of the entire

system. SCHOTT Eternaloc

®

terminal headers are

the safest, most proven solution available in the

market.

What’s your next milestone?