LNG

NEWS

8

LNG

INDUSTRY

MARCH

2016

DIARY DATES

USA

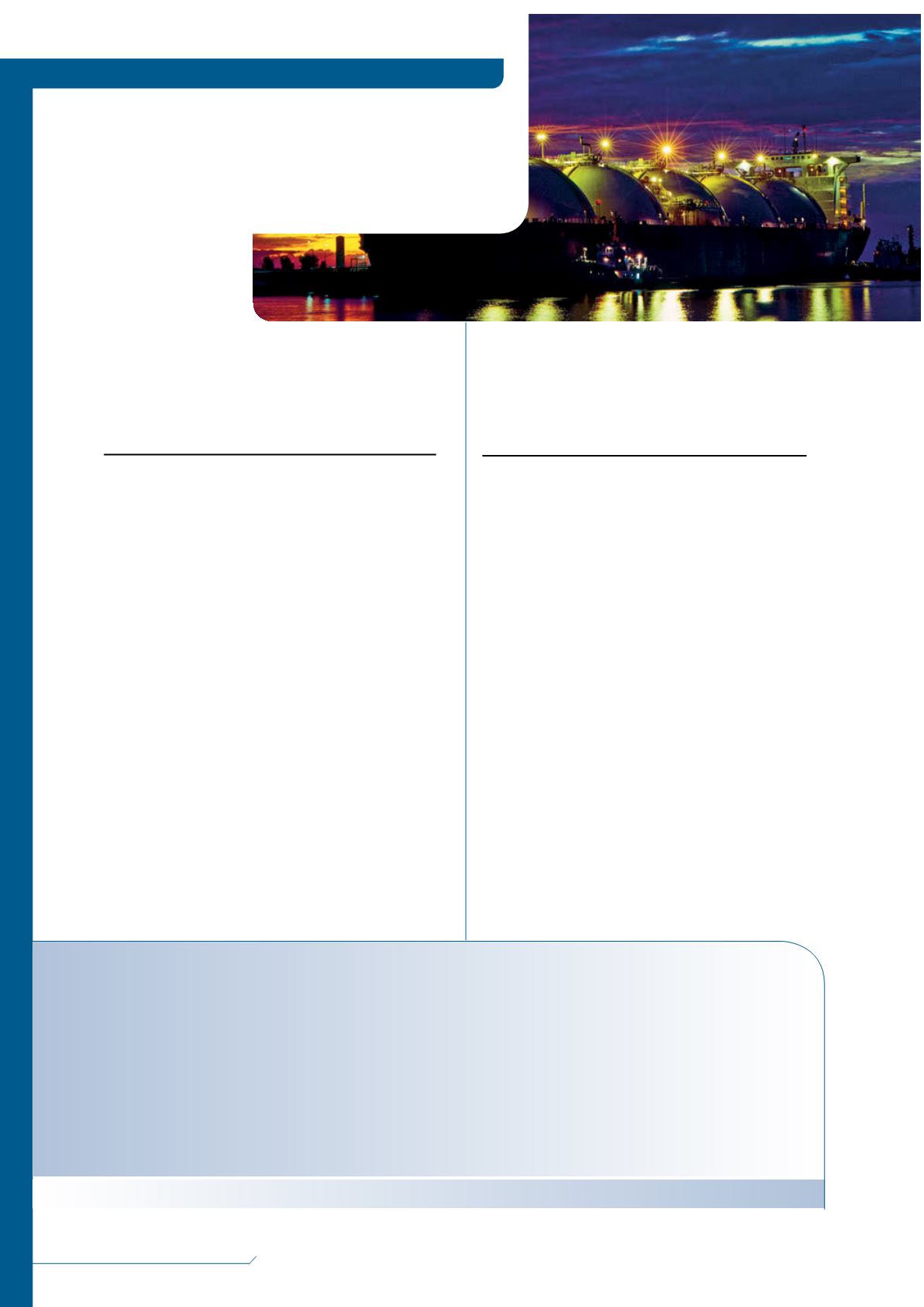

Emerson to automate liquefaction project

E

merson Process Management has announced

that it has been chosen by Cameron LNG to help

automate its new liquefaction project, adding three

LNG trains to facilitate export of domestic natural

gas to international markets. The company has been

awarded automation contracts for more than half of all

North American LNG export capacity.

Cameron has chosen Emerson Process Management

to provide automation expertise and technologies that

will help Cameron manage the LNG facility’s operations

safely and efficiently.

Three new liquefaction trains will give the

Hackberry, Louisiana, facility the flexibility to export up

to 12 million tpy of US produced natural gas.

Emerson will provide its DeltaV™ distributed

control and DeltaV SIS integrated safety system for

both new and existing portions of the facility. It will

also provide its AMS Suite predictive maintenance

software to optimise the availability and performance

of key production assets. Project specialists in Houston

and in Pune, India, will provide related design and

configuration services to help accelerate the project

schedule.

Norway

Höegh LNG receives financing for seventh FSRU

H

öegh LNG Holdings Ltd has announced that

it has received commitment letters for the

US$223 million financing of its seventh floating

storage and regasification unit (FSRU). The financing

is able to fund 65% of the delivered cost, with a

15-year amortisation profile increasing to 75% and

20 years, respectively, upon a long-term contract

being secured. The structure, which has a five-year

post-delivery tenor, has the flexibility to be able to

be dropped down to Höegh LNG Partners LP together

with the FSRU. The interest rate will be swapped, and

it is expected that it will be fixed at approximately

3.8%. The commitments remain subject to final

documentation. The vessel is scheduled for delivery at

the end of 1Q17.

President and CEO of Höegh LNG Holdings Ltd,

Sveinung J.S. Støhle, said: “With this transaction,

Höegh LNG has once again secured competitive debt

financing for its FSRU fleet expansion, and this time

at the lowest cost ever achieved by the company.

The financing terms reflects the financial strength of

Höegh LNG’s balance sheet in addition to its position

as the market leader in the FSRU segment.”

17 - 18 March 2016

China LNG International Summit &

Exhibition

Beijing, China

11 - 15 April 2016

LNG 18

Perth, Australia

09 - 12 May 2016

Flame

Amsterdam, the Netherlands

29 August - 01 September 2016

ONS

Stavanger, Norway

06 - 09 September 2016

SMM

Hamburg, Germany

04 - 07 April 2017

Gastech 2017

Tokyo, Japan