14

LNG

INDUSTRY

SEPTEMBER

2016

to be impacted in the short-term by slower than expected

economic growth and by an increase in nuclear power

generation in Japan. This is likely to result in oversupply in

the LNG market persisting beyond 2021.

Despite these near-term concerns, the long-term

outlook is largely positive. LNG demand from other

countries in Asia will ensure a demand-supply balance

over the long-term. The Chinese government’s

commitment to switching from coal to gas power

generation to reduce greenhouse gas (GHG) emissions is

expected to continue – the construction of hundreds of

coal-fired plants was recently halted. Furthermore,

economic growth forecasts for India remain strong – the

government aims to narrow its domestic demand-supply

gap by using LNG.

Global market overview

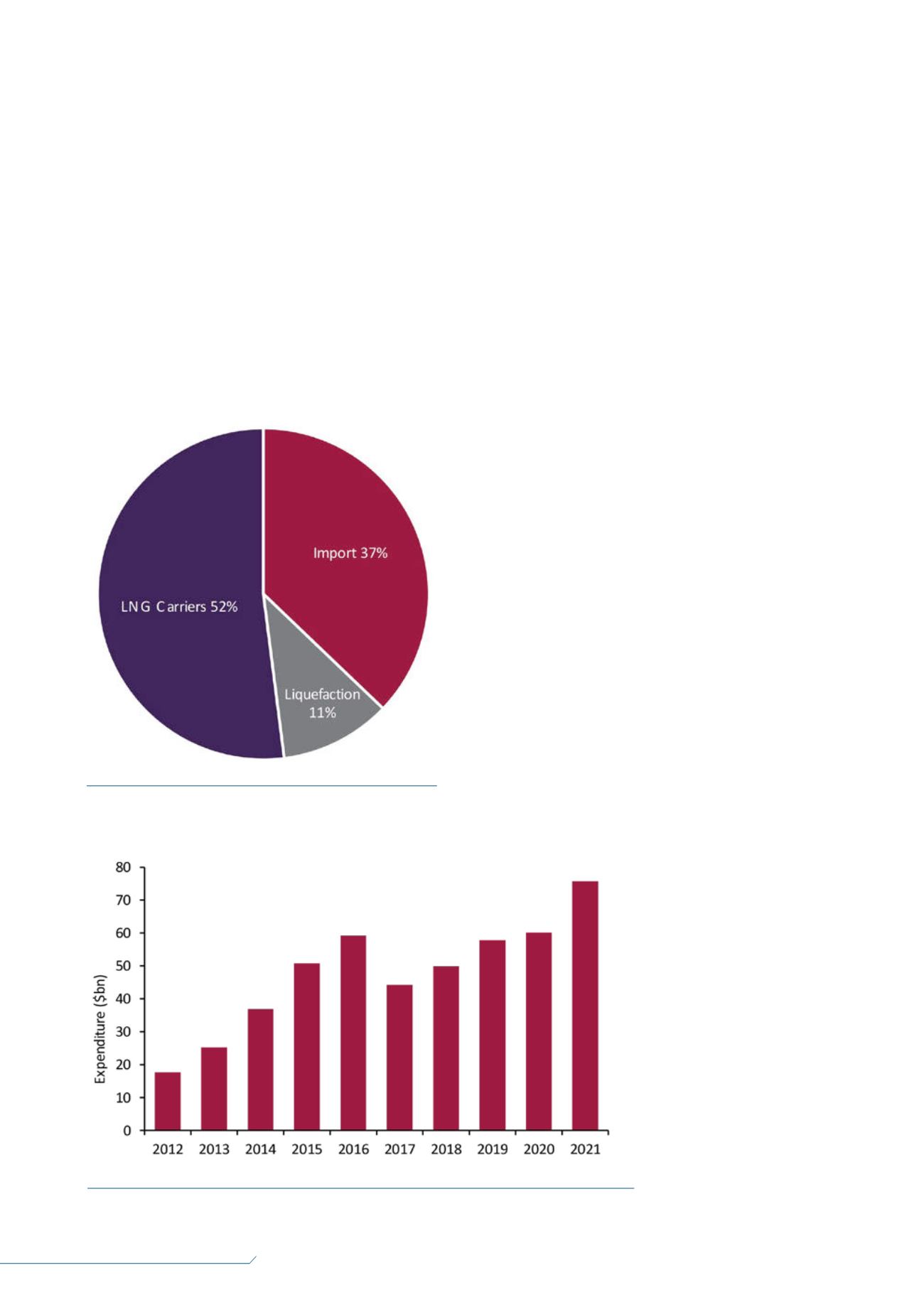

CAPEX on LNG facilities is expected to increase over the

forecast period of 2017 – 2021. This is primarily due to

a number of large North American liquefaction projects

currently under construction. Total expenditure on LNG

facilities is expected to reach US$284 billion over the

forecast period – an increase of 50% compared to the

2012 – 2016 period.

The expenditure outlook over the forecast period is

one of fairly steady growth. However, 2017 and 2018 are

likely to be weaker years, due to reduced project

sanctioning as a result of current market oversupply,

which has largely influenced LNG spot prices. In Asia,

average LNG prices in June 2016 were 69% lower than

June 2014. Despite reduced expenditure in the near-term,

spending is expected to increase in the latter years of the

forecast period. This will be supported by continued

investment in North America and an expected resurgence

in the LNG carrier market.

Over the forecast period, there will be a regional swing

in investment from Australasia to North America, with

liquefaction projects currently under construction in

Australasia expected to reach completion by 2017.

Projects that were expected to trigger a second phase of

investment have either been delayed or cancelled.

Liquefaction projects will account for the largest

proportion of total expenditure, reaching US$192 billion

over the 2017 – 2021 period. This represents an increase of

42% compared with the 2012 – 2016 period.

Import facilities will represent 14% of total expenditure

over 2017 – 2021. Overall, a total of US$38 billion is

forecast to be spent over the next six years – a rise of 25%

compared with the 2012 – 2016 period. Many of these

projects will be built in Asia, as well as countries without

import capability, enabling access to the global LNG

market.

Expenditure on LNG carriers will account for 19% of the

global total, reaching US$54 billion over the forecast

period. Due to the current lack of carrier orders,

Douglas-Westwood (DW) expects that approximately 164

potential additional units –

totalling US$33 billion – will

be required towards the end

of the forecast period. The

majority of these potential

units are expected to be

required to support

additional export capacity to

be installed in

North America.

Southeast

Asia in focus

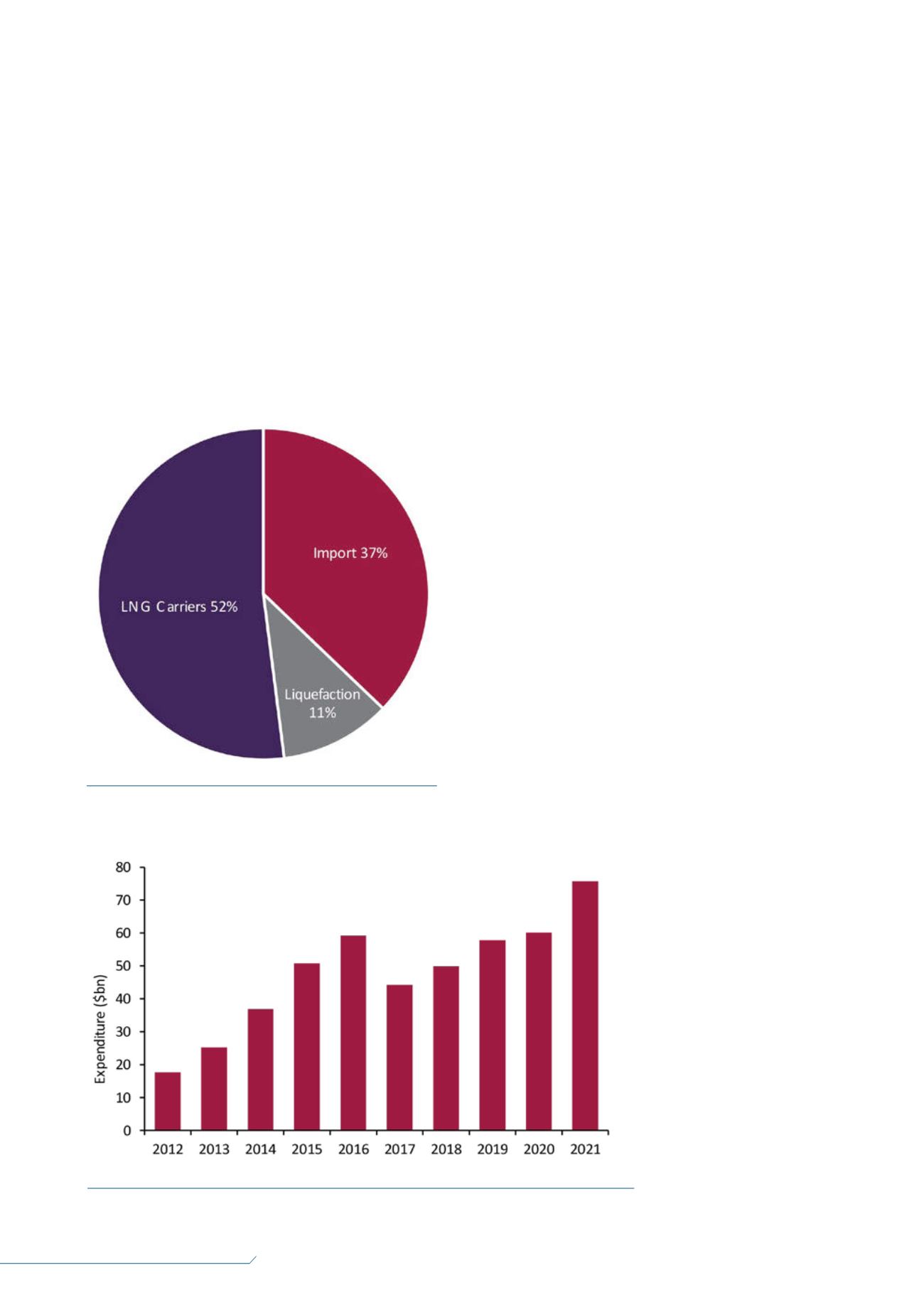

Asia is set to marginally

increase its share of global

LNG CAPEX from 30%

during the hindcast to 33%

over the forecast period. The

construction of LNG carriers

is expected to account for

a large proportion of the

increase in expenditure,

Figure 2.

Global LNG expenditure 2012 – 2021 (source: Douglas-Westwood, World LNG Market

Forecast 2017 – 2021).

Figure 1.

CAPEX on LNG facilities in Asia 2012 – 2021 (source:

Douglas-Westwood, World LNG Market Forecast 2017 – 2021).