14

LNG

INDUSTRY

JULY

2016

However, emissions from the burning of fossil fuels have become

an increasingly important consideration in recent decades. Climate

change has emerged as key policy issue and, consequently, natural

gas is seen by many as necessary to support the transition to low

carbon energy. Proven to emit half of the greenhouse gases (GHG)

of coal, natural gas provides a mechanism to rapidly reduce

emissions and will see the highest fossil fuel demand growth to

2040. In 2015, the COP21 agreement outlined a clear roadmap to

the reduction of GHG emissions. This is expected to be a key driver

of changes to energy policy and growth in gas use. Beyond

environmental concerns, seasonal gas demand is also a clear driver

of LNG inWestern Europe, Latin America and theMiddle East. In

these regions, rising LNG demand is often due to declining local gas

production and not necessarily overall gas demand growth.

Globally, many basins with relatively low extraction costs have

matured. Consequently, exploration and production (E&P)

companies have been forced to develop higher cost plays, notably

deepwater, heavy oil and oil sands. Conversely, the gas market has

enjoyed a period of booming production underpinned by the advent

of shale gas in North America and coal bedmethane (CBM). This

previously stranded gas is now being transported to consumers via

LNG technology.

A combination of plummeting oil prices and a sharp fall in the

economic growth profiles of many Asian countries has, in recent

months, caused the LNG spot price to fall substantially. Asia is a key

region of demand growth, yet pricing has struggled. In April 2016,

Japan’s LNG spot price averaged US$7.75/million Btu – a 24%

decline compared to the same period 12months prior. Sustained

low oil price remains a concern for the LNGmarket, as most LNG

contracts are linked to oil price. Furthermore, various LNG

developments are vulnerable to capital constraints from the decline

in oil price, given that liquefaction projects are very capital intensive.

Market overview

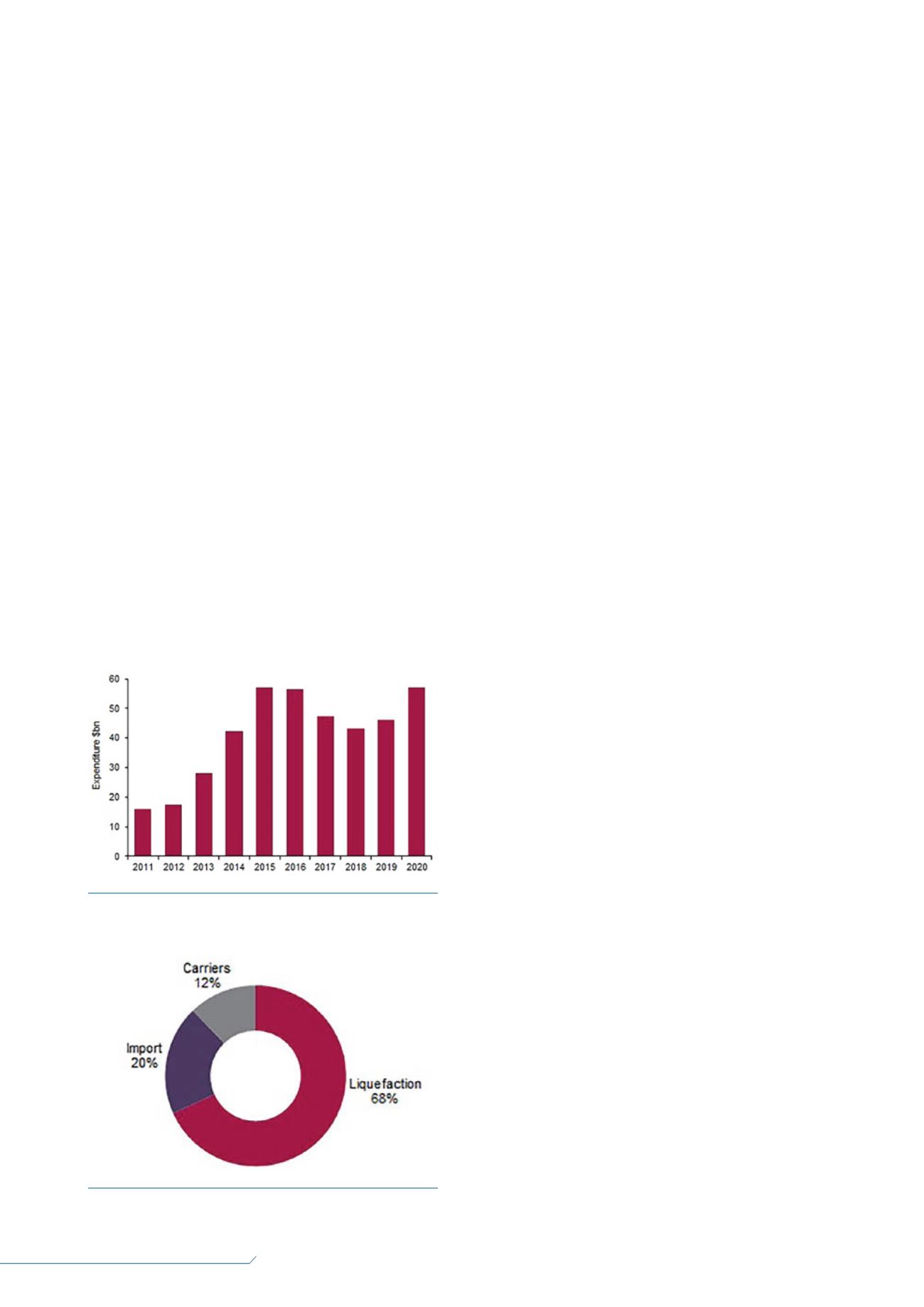

CAPEX on LNG facilities has been predominantly driven by large

liquefaction facilities in Australia over the 2011 – 2015 period. Over

the next five years, CAPEXwill be driven by numerous projects in

North America and a handful of projects in Africa. Owing to the

number of projects that are currently under construction and those

approaching Final Investment Decision (FID), Douglas-Westwood

(DW) forecasts expenditure on global LNG facilities to total

US$250 billion between 2016 and 2020. This represents a 56%

increase compared to the preceding five year period.

Over the forecast period, all regions are expected to experience

steady growth in CAPEX, with the exception of Australasia, where

the LNG construction boom looks to be coming to an end. Several

Australianmega-projects, such as Gorgon LNG, Ichthys LNG and

Wheatstone LNG, are expected to be fully operational by 2018.

Furthermore, FID has not been taken on any Australian LNG project

since 2012. With commodity prices depressed, future LNG projects

in Australia are uncertain. Those currently in the front end

engineering design (FEED) stage are struggling tomake economic

sense in the low price environment.

Over the next five years, there will be a significant shift in

expenditure to North America for the construction of new LNG

facilities. Despite the long-winded approval process in the US and

Canada, the North American region will account for 24%of total

expenditure on LNG facilities over the 2016 – 2020 period. Projects

such as Sabine Pass LNG Train 1 – 4, Freeport LNG Train 1 – 3,

Cameron LNG Train 1 – 3 and Bear Head LNGwill drive expenditure

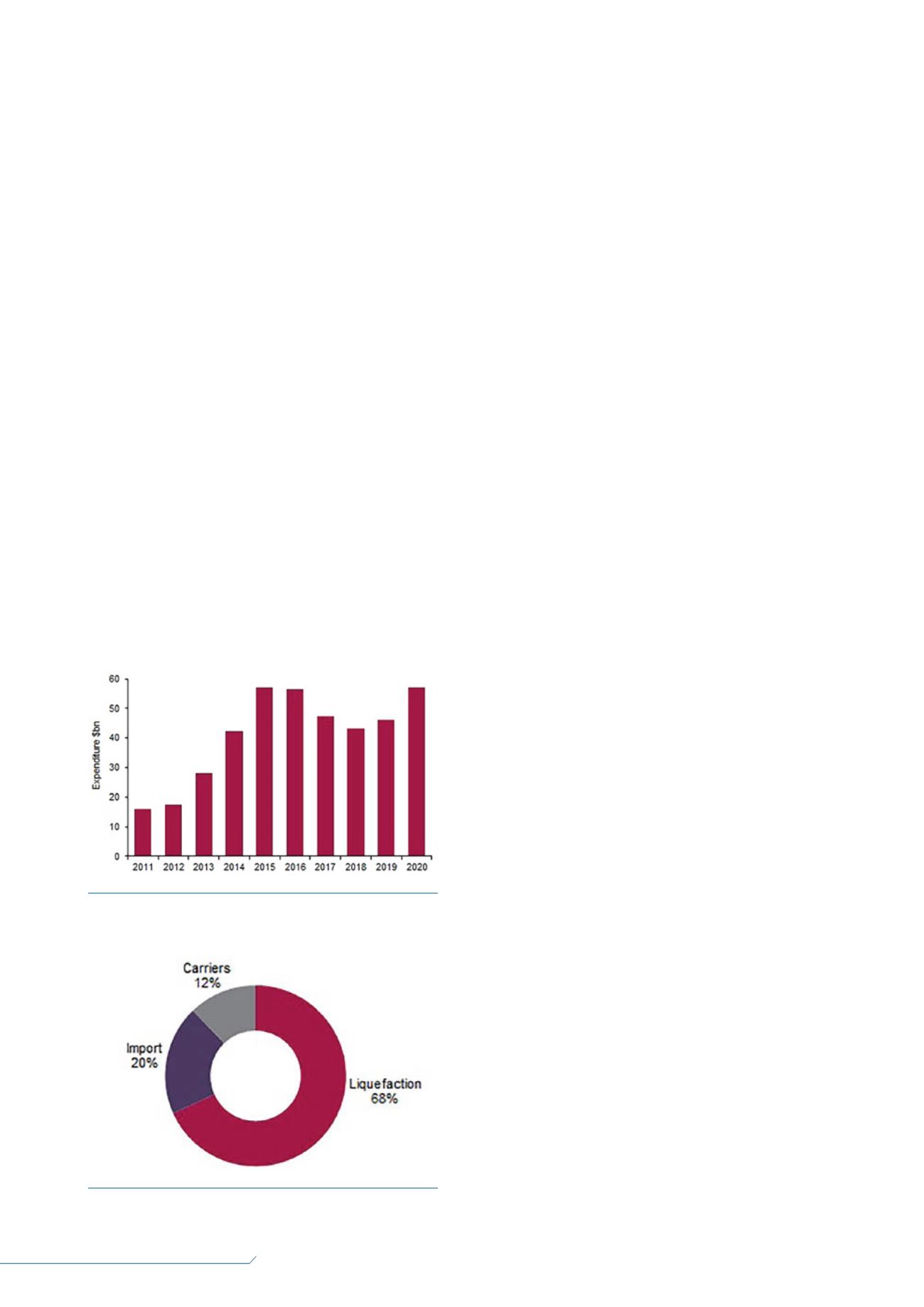

in the region over the forecast period. By far the largest proportion

of global LNG expenditure will be attributed to liquefaction projects.

This accounts for 68%of spend over the forecast period. Import

facilities will constitute 20%, whilst spend on LNG carriers will

represent 12%of total expenditure between 2016 and 2020. It is

pertinent to state that the Asian shipyards are expected to service

nearly all carrier shipbuilding contracts over the next five years.

Africa in focus

During the preceding five year period, activity on liquefaction

developments was limited, with a handful of projects, such as

the Skikda GL1K Phase 2 Replacement, Angola LNG Train 1 and

Gassi Touil (GL3Z LNG), all becoming operational over this time.

However, Angola LNGwas temporarily shut down in 2014 after

a ruptured pipe. The facility has a capacity of 5.2million tpy and

represents a significant project for the Angolan energy sector.

However, the facility has experienced significant delays and

production only resumed in June 2016.

Over the next five year period, DW forecasts expenditure on

LNG facilities in Africa to grow at 103%CAGR, with spend totalling

US$21 billion – an overall increase on the previous five year period

of 26%. Despite delays, such as to the seventh train in the

Bonny Island project, Engie’s Cameroon LNG project and the

Ethiopia –Djibouti LNG project will account for themajority of

expenditure in the near-term. The significant growth in CAPEX seen

by the end of the forecast period is as a result of the

commencement of construction activity on the proposed

Afungi LNG Train 1 and 2. This project is expected to contribute a

total of 12million tpy of liquefaction capacity when completed.

However, despite progress made, with FEED studies already

completed, the absence of infrastructure, lack of skilled personnel

and regulatory uncertainties might cause delays to the

Figure 1.

Global LNG expenditure 2011 – 2020 (source:

Douglas-Westwood (DW), World LNG Market Forecast).

Figure 2.

Global expenditure by LNG facility type 2016 – 2020

(source: DW, World LNG Market Forecast).