32

LNG

INDUSTRY

OCTOBER

2016

they improve their performance to match that of the

leading companies. This has resulted in cost savings for

many terminals. Table 2 shows average changes in cost

performance for the benchmarking group from 2012 to

2015. Overall, a significant decrease in total OPEX of

11% was observed, with a similar saving in maintenance

and a larger saving of 29% in functional support services

(health, safety, security, environment and quality (HSSEQ),

engineering and laboratory). Only in the area of operations

was there a minimal increase in cost performance during

this period, which may be expected given the ongoing

regulatory requirements for minimum manning levels in

this area, thereby limiting opportunities for cost reductions.

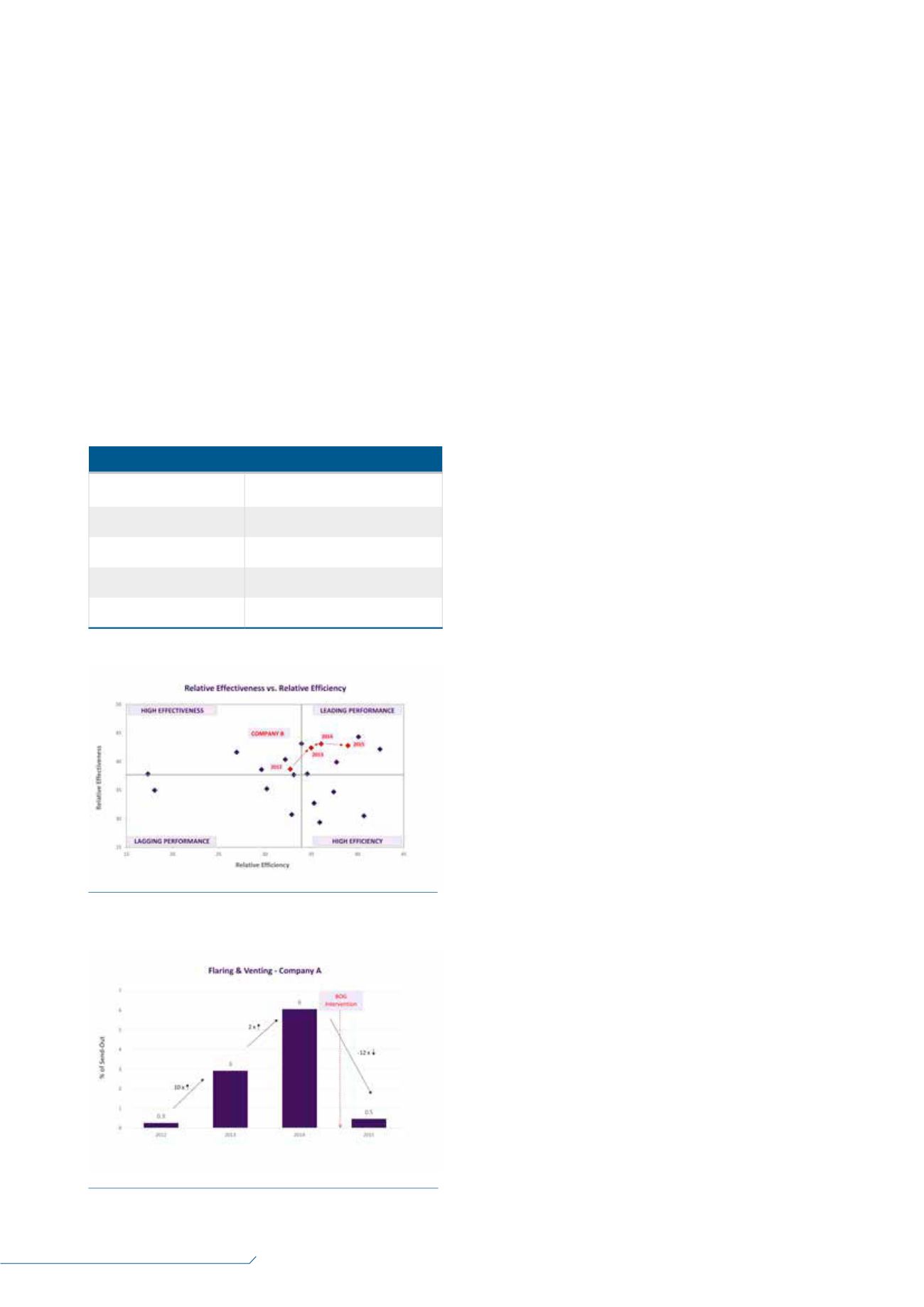

The aim of any terminal is to be strong in terms of both

efficiency and effectiveness. All companies want to

maximise the quality of their outputs, whilst optimising

cost and manpower levels. Thus performance in areas such

as health, safety, environment, integrity availability and

reliability all carry equal importance to operating

efficiently. The relative effectiveness and efficiency

performance of each of the benchmark terminals is shown

in Figure 3. The quadrants, depicted by median

performance levels, determine the strategy that each

terminal should adopt for improvement. The objective of

the benchmarker is to attain a leading position where both

effectiveness and efficiency performance are optimised

(upper right quadrant). Figure 3 also shows the

improvement journey of one terminal (Company B) from

2012 to 2015, as it learnt from the benchmarking and acted

upon the findings of the analysis to deploy improvement

projects and realise step changes to performance. During

this period, it achieved total cost savings of 20%, whilst

maintaining terminal availability and reliability at 100% and

halving the number of overdue work orders.

The benchmarking indicated that expenditure on

contractors at one terminal was particularly high. Acting on

the findings of the benchmarking, the company was able to

realise significant cost savings. It examined ways in which

its reliance on third party contractors could be reduced

through utilising its own staff wherever possible. It also

reviewed key contracts and established long-term

contracts with selected vendors, thereby reducing hourly

rates.

Another terminal discovered that the manpower time

spent on operations was well above many of the leading

terminals. It assembled a multifunctional improvement

team, including personnel from maintenance and safety

and identified more than 20 maintenance tasks that could

be conducted by operations staff. In so doing, it was able

to absorb over 1700 man-hours of maintenance time into

operations, which, in turn, not only realised a cost saving,

but also more effective completion of the tasks.

Maintenance efficiency was the focus for a third

terminal that achieved y/y improvements resulting in a 14%

improvement in manpower productivity over a 4-year

period, through the introduction of a totally revised

maintenance strategy. An organisation was put in place,

centred around an asset management philosophy

compliant with ISO55001 and with a risk-based approach.

The resulting increased focus on maintenance

programming, supervising and quality control enabled the

company to execute the work with fewer resources.

It is not only about cost

Whilst attaining a cost leadership position is an objective

of most terminal operators, it is also essential to ensure

that performance is as effective as possible. One of the

benchmarked terminals discovered that its maintenance

planning was not as effective as its peers’. In order to

gain better control, it introduced some of the KPIs used

in the benchmarking into its maintenance management

system and, as a consequence, was able to measure its

maintenance backlog more accurately, resulting in more

accurate maintenance planning compliance. Another

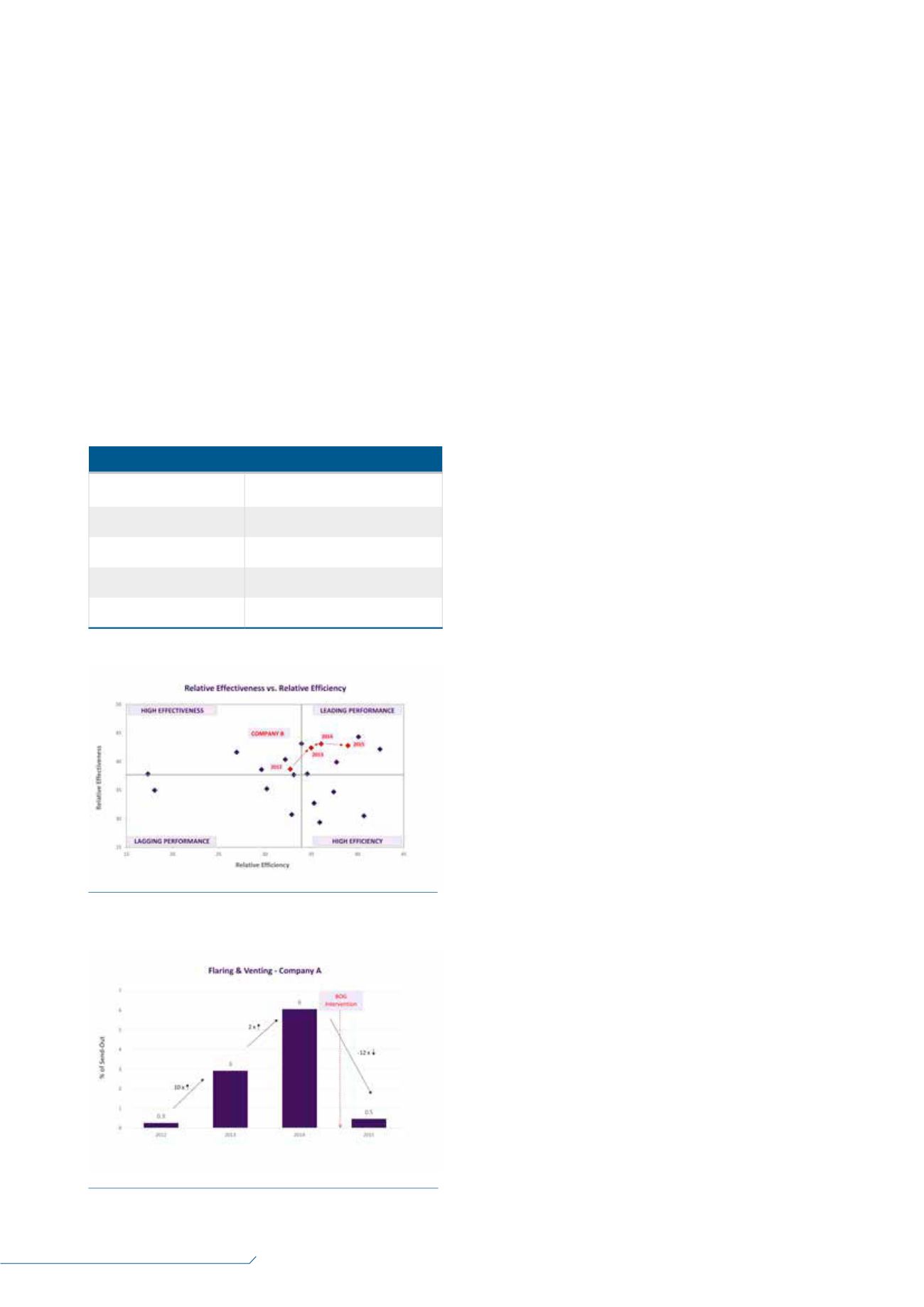

terminal recognised that it had increasing levels of flaring

y/y (Figure 4) as a result of increased boil-off gas (BOG)

caused by minimal send-out levels. Through the sharing of

best practices amongst the group, the company was able

to learn from the other benchmarkers to identify technical

improvements that could be adapted and adopted at

Table 2.

Performance averages for the benchmarking group

Peformance area

Change in performance

(2012

–

2015)

Terminal total costs

11% decrease

Operations costs

3% increase

Maintenance costs

11% decrease

Functional support costs

29% decrease

Figure 3.

Comparing terminal efficiency and effectiveness.

Figure 4.

Patterns in flaring and venting at one terminal

from 2012 to 2015.