20

LNG

INDUSTRY

OCTOBER

2016

In the last decade, the LNG supply contracts have started to

allow for greater flexibility to be more in line with the demands

of today’s customers. Many LNG offtakers face seasonal

demand fluctuations due to the summer air conditioning loads

or the winter heating season, which they would like to see

reflected in their contracts. Pricing LNG to major pipeline gas

benchmark prices has been suggested as an alternative to oil

price indexing, especially during the time when oil prices were

approximately US$100/bbl. LNG producers regularly have spot

cargoes available that are excess to contracted supplies. These

spot cargoes are usually sold through tenders. With more LNG

producers in the market, the number of spot cargoes also

increased. Seeing an opportunity for trade, commodity traders

such as Gunvor and Vitol have entered the LNG market, buying

and selling LNG cargoes around the world. A number of oil

majors have also begun to trade LNG on a portfolio basis;

cargoes from their own LNG plants and from positions they

have taken in other LNG plants are distributed to their offtakers

and to spot cargo buyers. All of this has increased the liquidity in

the LNG market.

In 2015, approximately 28% of the total LNG volume was

traded on a spot or short-term basis against 16% in 2006. This

allows LNG buyers to optimise their LNG supplies, using

long-term contracts to cover most of the demand and spot

cargoes to adjust for seasonal fluctuations and exploit the

opportunity to save money when spot prices are low. These

spot and short-term cargoes also require shipping from the LNG

plant to the offtaker. LNG ship brokers are working to match up

the shipping demands for these cargoes with the LNG carriers

available in the market. With well over 100 ships still to come

out of the shipyards and into the market, which is short on

cargoes and long on LNG carriers, LNG ship brokers will be

spending a significant amount of time trying to keep all of these

ships trading.

The short lived golden age of

gas

Methane has the lowest CO

2

emissions per energy unit when

combusted compared to other fossil fuels, such as gasoline,

diesel and coal. Therefore, LNG, which is predominantly

methane, is the most environmentally friendly fossil fuel. In

this time of growing environmental awareness, the future

seems bright for LNG. In 2011, the International Energy Agency

(IEA) pronounced the golden age of gas.

1

In the US, the shale

revolution was just starting to bring untold amounts of cheap

gas to the market, ripe for export as LNG. In Australia, large LNG

plants were under development, slated to bring 65 million t of

LNG to the market. China’s booming economy required a

significant amount of fuel, and LNG was one of the fuel sources

that the country selected. Following the temporary shutdown

of the Japanese nuclear power plants in the wake of the

Great Tōhoku earthquake in 2011, Japanese power producers

turned to LNG to make up the difference. Already the leader

in LNG imports at the time, Japan increased its imports by

20 million tpy to approximately 90 million tpy. LNG prices rose

and LNG shipping rates climbed too. During this period, oil had

been hovering around US$100/bbl. High oil prices translated

into higher LNG prices via the oil indexing, which was hurting

LNG importers even more. Seeing the growing disparity

between oil and gas pricing, importers started to request a

gas-to-gas indexing when renewing LNG supply contracts, in

the hope that they would be able to keep the energy cost rise

under control. For a moment, the future of gas seemed golden.

Then came mid-2014 and a perfect

storm hit the LNG market. Oil started a price

slide from US$105/bbl in June 2014 to less

than US$30/bbl in January 2016. China’s

booming economy started showing signs of

slowing down. Meanwhile, Japan was

scaling back its additional LNG imports. The

same US shale revolution that brought

massive amounts of gas to the market also

brought equally massive amounts of oil to

the market. The Organization of Petroleum

Exporting Countries (OPEC) saw its role as

the leading oil supplier challenged and

responded by flooding the market with oil in

order to drive out the US shale producers.

Oil prices dropped rapidly due to the excess

oil supply in the market. LNG prices started

dropping too for two main reasons: oil

indexing and excess supply. The price of

LNG dropped through oil indexing and

because the increased LNG volumes that

became available on the market were no

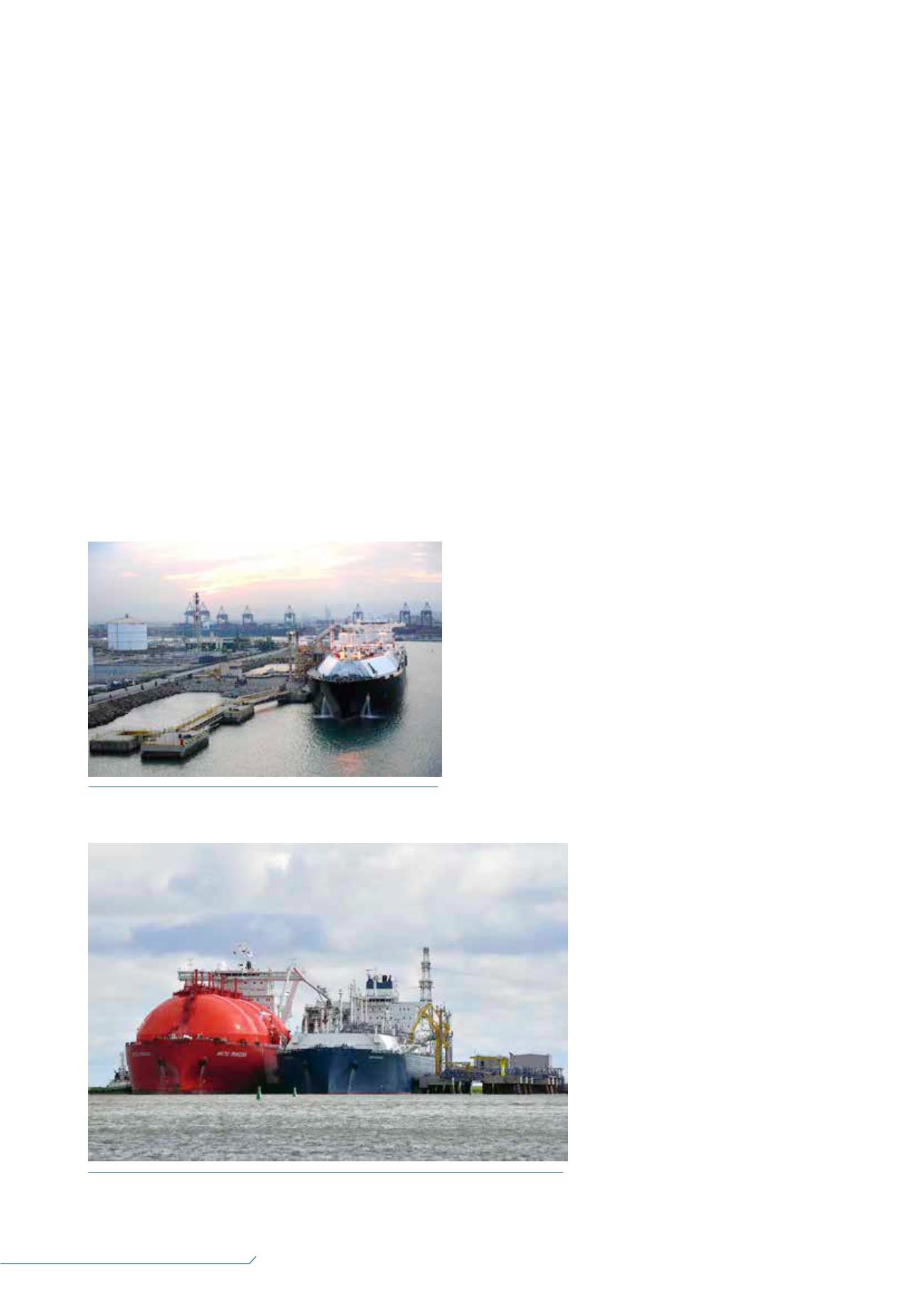

Figure 1.

The traditional LNG wholesale business: an LNG

carrier docked at an LNG terminal (source: Shutterstock).

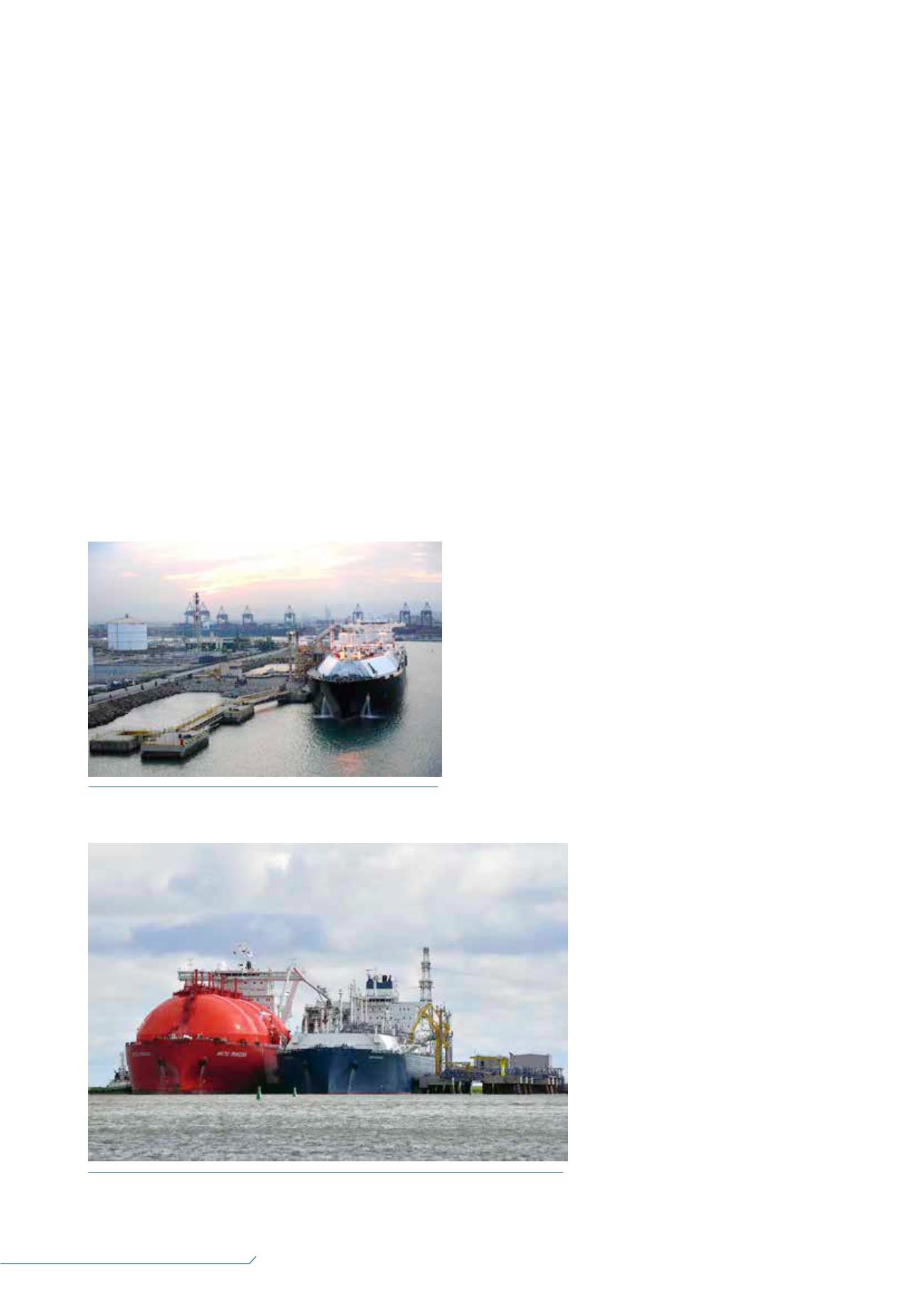

Figure 2.

A floating storage regasification unit (FSRU) providing a quick start to LNG

imports for countries seeking energy independence or wanting to import cheap energy

through LNG (source: Shutterstock).