16

LNG

INDUSTRY

OCTOBER

2016

Over the same period, when the construction of

export facilities thrived within the region, import facilities

have been practically restricted to floating units, with the

exception of the Marmara Ereğlisi (1994) and Izmir Aliağa

(2006) land-based import terminals in Turkey. Israel,

Jordan, Kuwait and the UAE have all deployed floating

import units over the past eight years in order to meet

increasing domestic demand for natural gas. The use of

LNG for power generation in the region has been rising

over the past decade. This trend is forecast to continue,

with Bahrain and Lebanon expected to commission their

first floating import unit over the 2017 – 2021 period.

Middle East in focus

The Middle East is currently the largest LNG exporting

region in the world, with six operational facilities that

run on 25 trains. However, the majority of these facilities

came onstream prior to 2011 and export levels are

expected to remain at current levels for the foreseeable

future as Qatar’s North Field production moratorium

remains in place. No liquefaction terminals are

expected onstream in Qatar within the forecast period.

Consequently, Australia is expected to overtake Qatar as

the world’s largest exporter by the end of 2017, and the

US soon after the forecast period.

A major influence on expenditure in the region over

the 2017 – 2021 period will be developments in Iran.

With the lifting of US, UN and EU nuclear-related

sanctions, investment is expected to gradually stream

back into the country – potentially restarting Iranian LNG

plans.

The majority of Iran’s planned LNG projects have been

stalled or suspended due to the impact of economic

sanctions. The Iran LNG project is currently the only

project under construction, comprising two LNG trains,

each with a capacity of 10.5 million tpy. The facility, which

is reported to be over 60% complete, is expected to be

operational by 2019. Other liquefaction expenditure is

associated with the prospective completion of other LNG

projects in Iran that were stalled due to the international

sanctions. The revival of these stalled projects (Pars LNG

and Persian LNG) should guarantee that the Middle East

remains the world’s largest exporter of LNG for the

foreseeable future. However, the financing structure of

these abandoned projects is currently unclear. The only

other expenditure on export facilities in the region over

the forecast is expected to be the replacement of the

Das Island 1 facility.

Export capacity in the Middle East over the

2012 – 2016 period remained at 100.1 million tpy.

However, this is expected to

increase to 110.6 million tpy

by 2021, driven by the

construction of the Iran LNG

terminal. However, due to

large increases in capacity in

Australia and the US, the

Middle East’s market share

of just over 28% in 2016 will

fall to 23% by 2021.

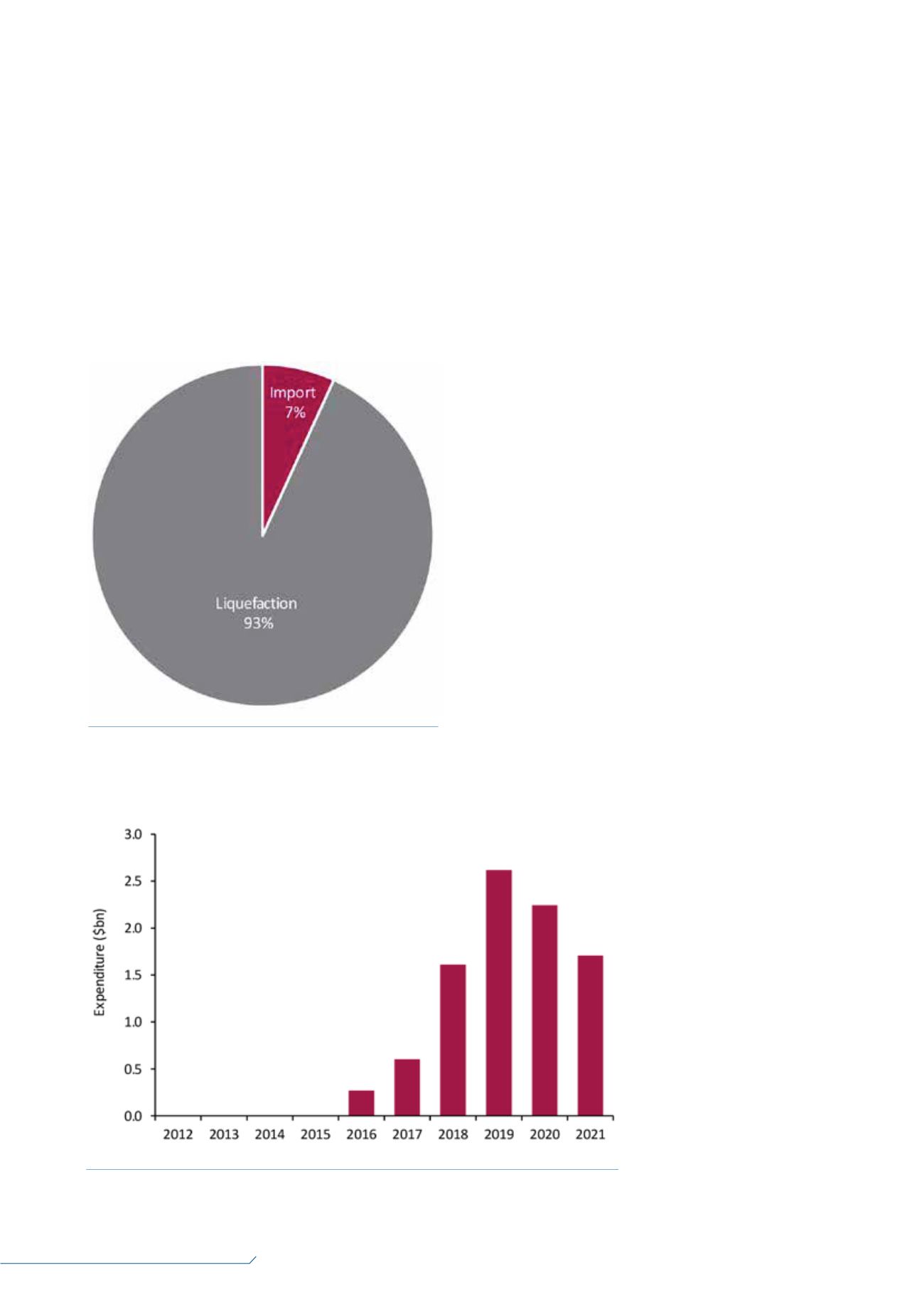

Despite the region being

a major exporter of LNG, a

couple of import terminals

are expected to be built

– with Turkey accounting for

the majority of expenditure

on import facilities. Another

potential import project

within the region is the

Kuwait National Petroleum

Corp. (KNPC) LNG facility in

Kuwait, which is expected to

come onstream by 2020.

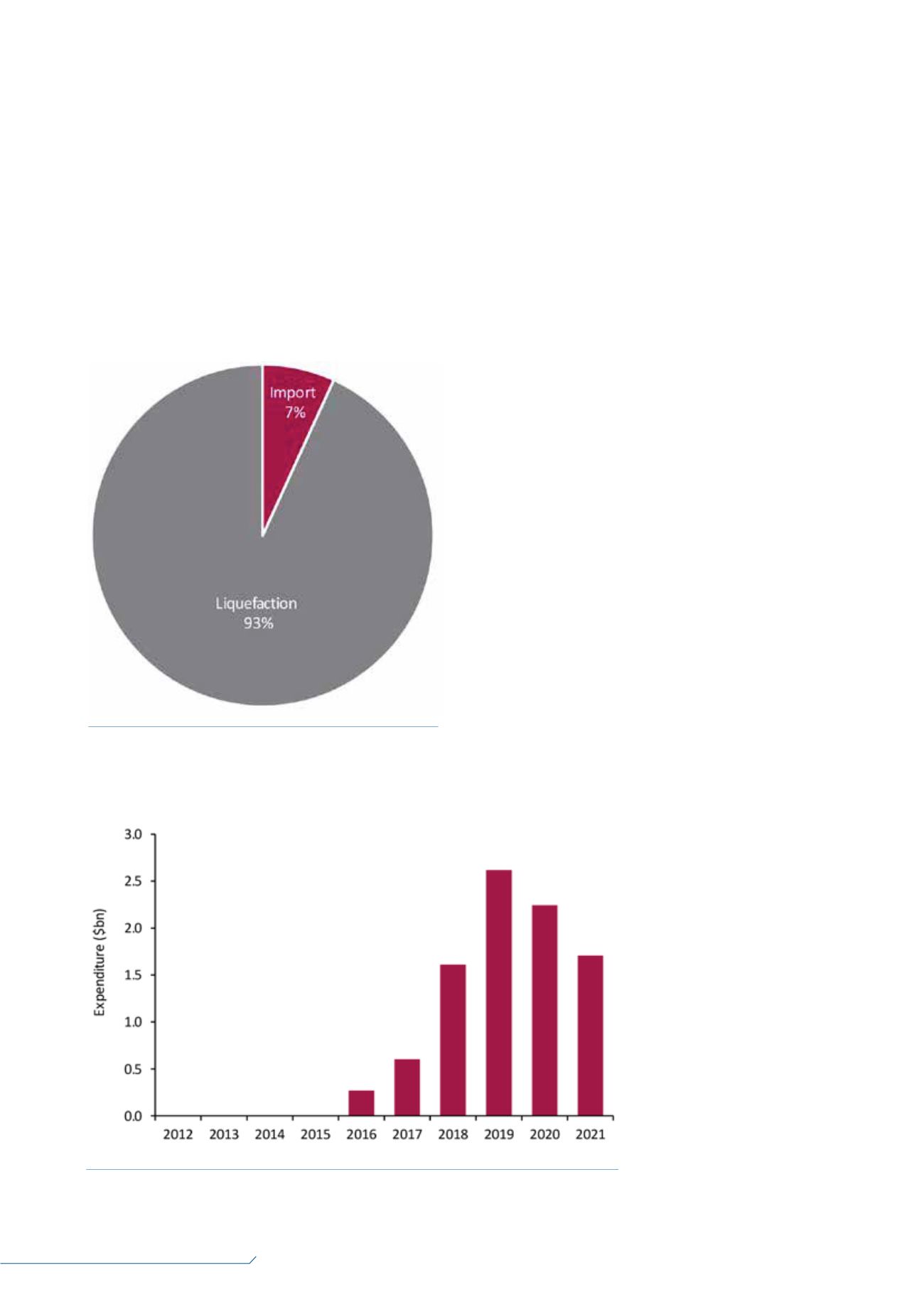

Figure 2.

Middle East expenditure 2012 – 2021 (source: Douglas-Westwood, ‘World LNG Market

Forecast 2017 – 2021’).

Figure 1.

CAPEX on LNG facilities in the Middle East

2012 – 2021 (source: Douglas-Westwood, ‘World LNG Market

Forecast 2017 – 2021’).